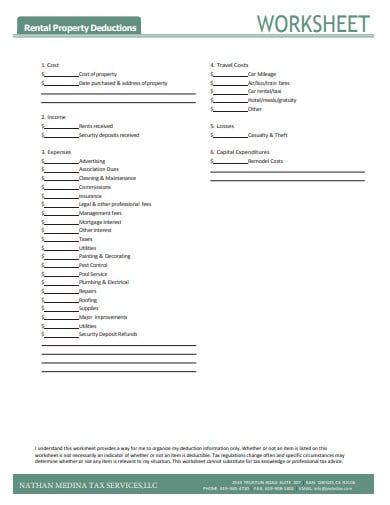

Rental Property Tax Deductions Worksheet

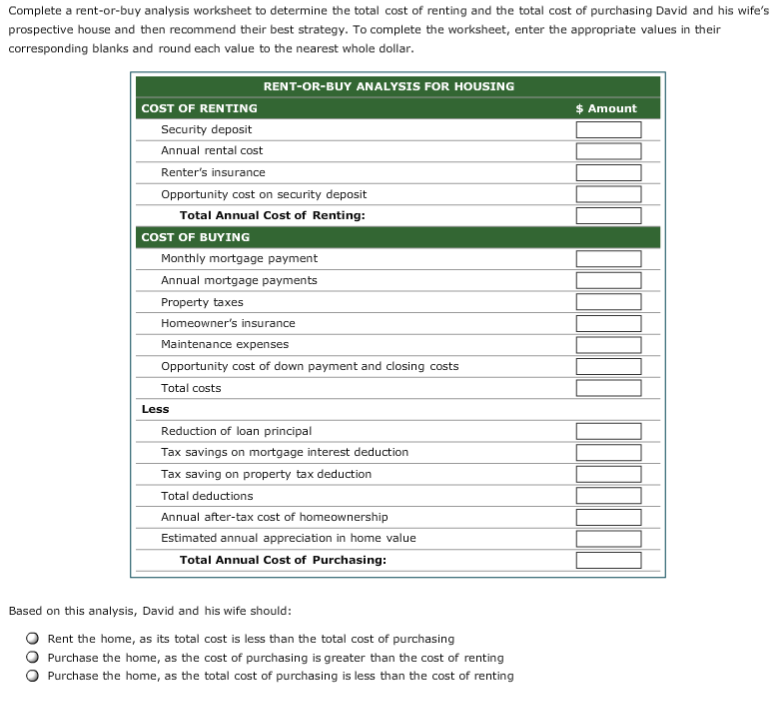

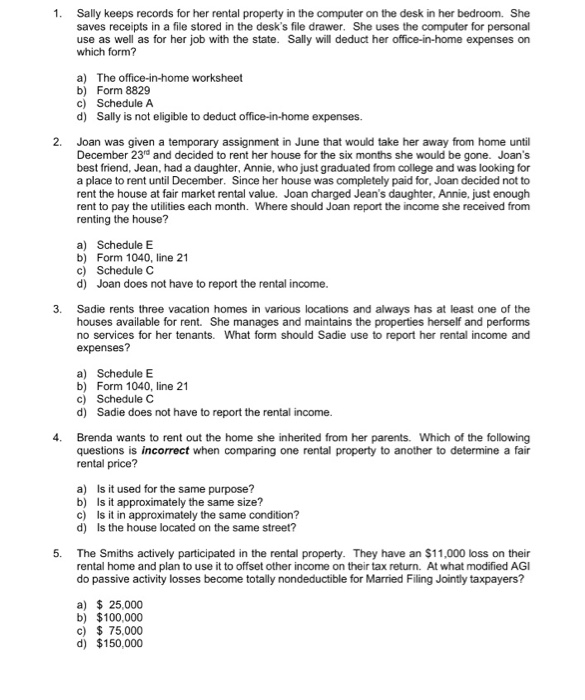

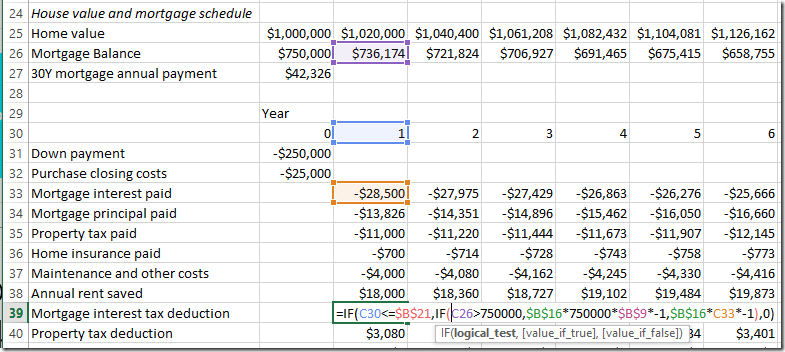

For example if you earn 10 000 from one rental property and have an 8 000 loss on another you can offset your 10 000 income with the 8 000 loss for a net taxable rental income of 2 000.

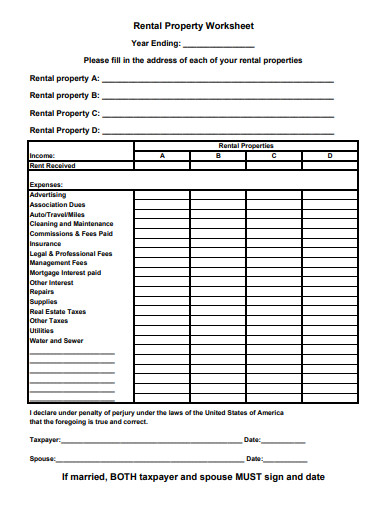

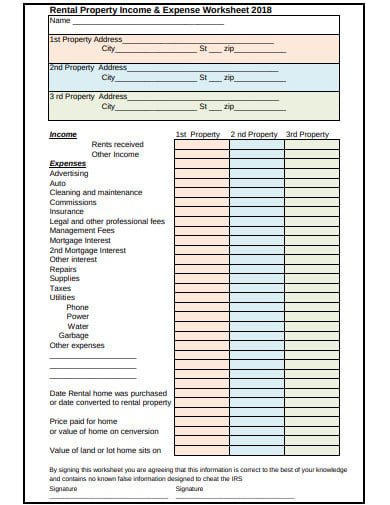

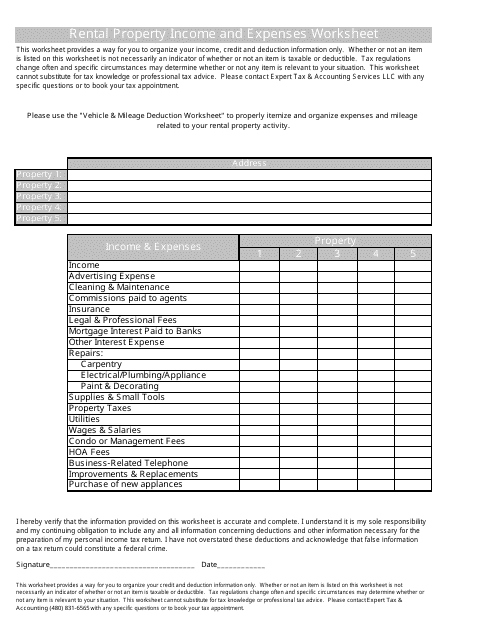

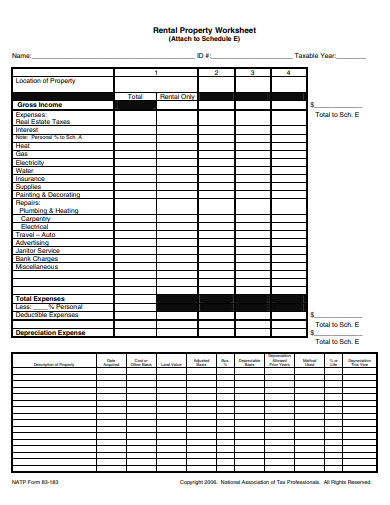

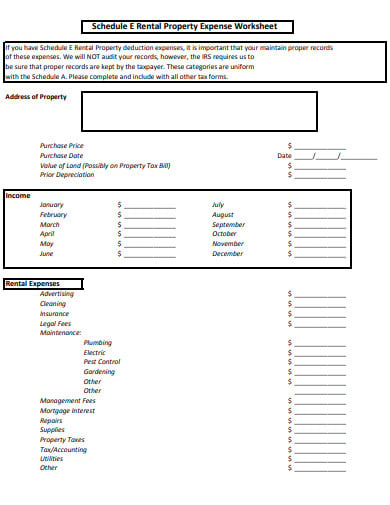

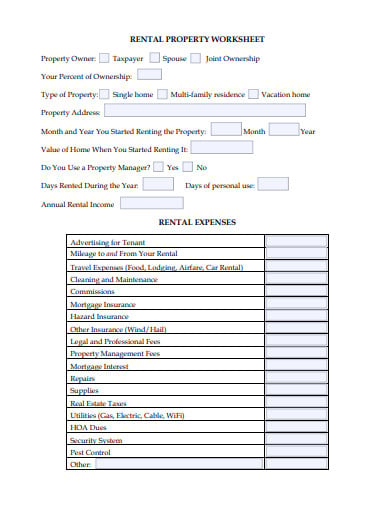

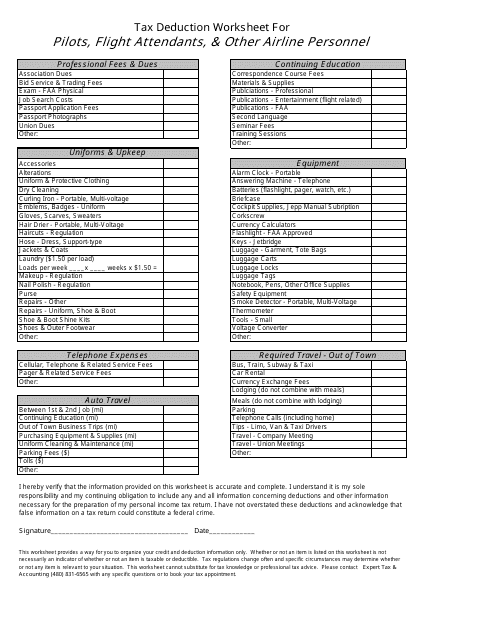

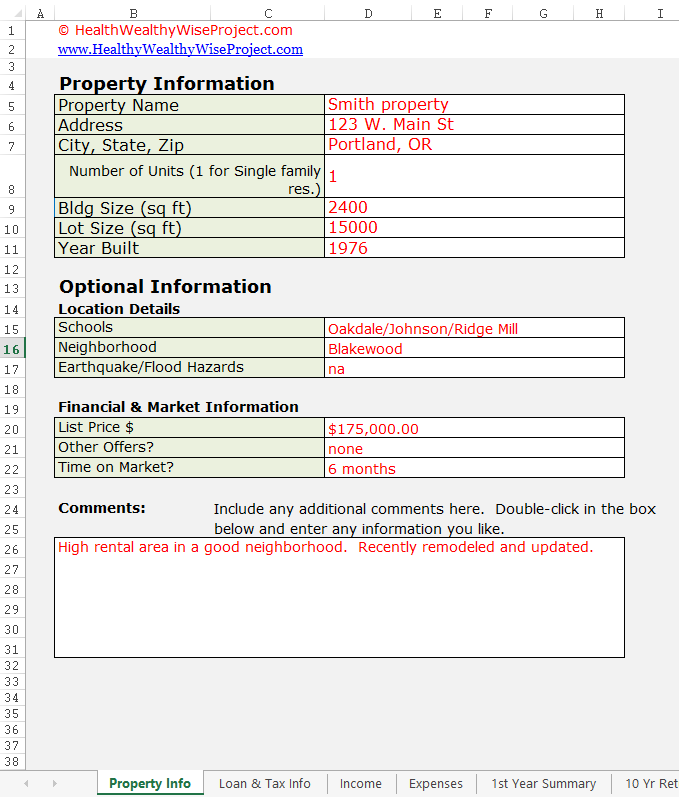

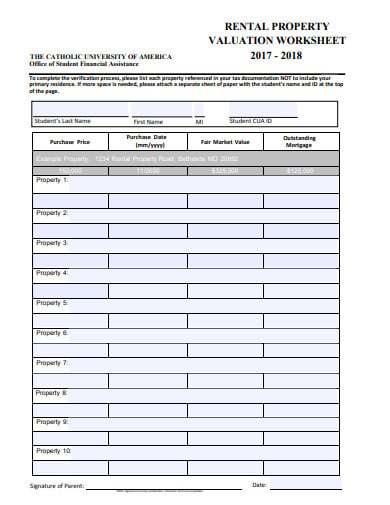

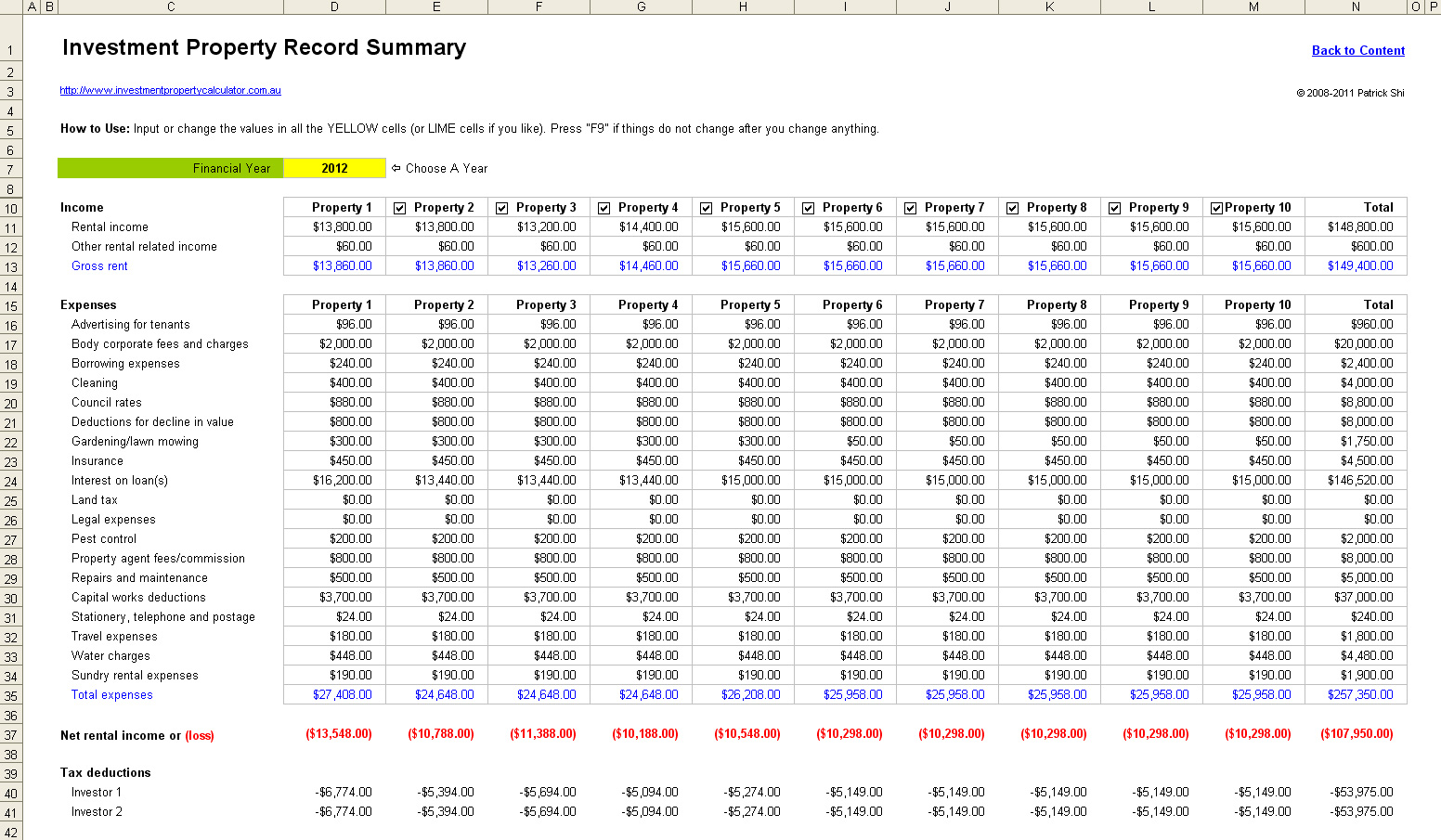

Rental property tax deductions worksheet.18 rental property worksheet templates in pdf free.15 per cent for rental residential properties in the residential or new multi residential property tax class.Sheet create base on rental income from each property after deduction of expenses amount from each one.

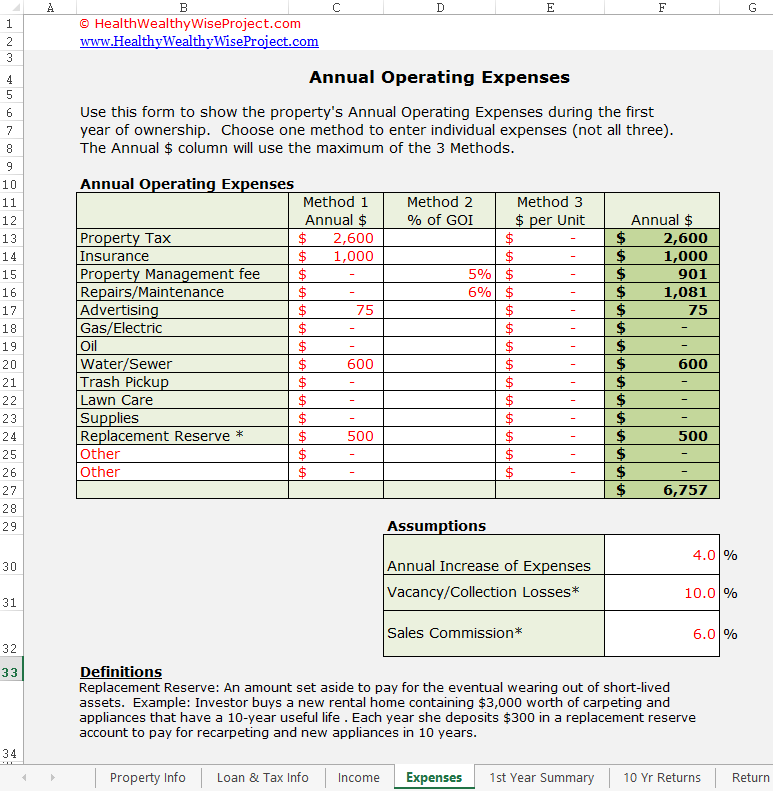

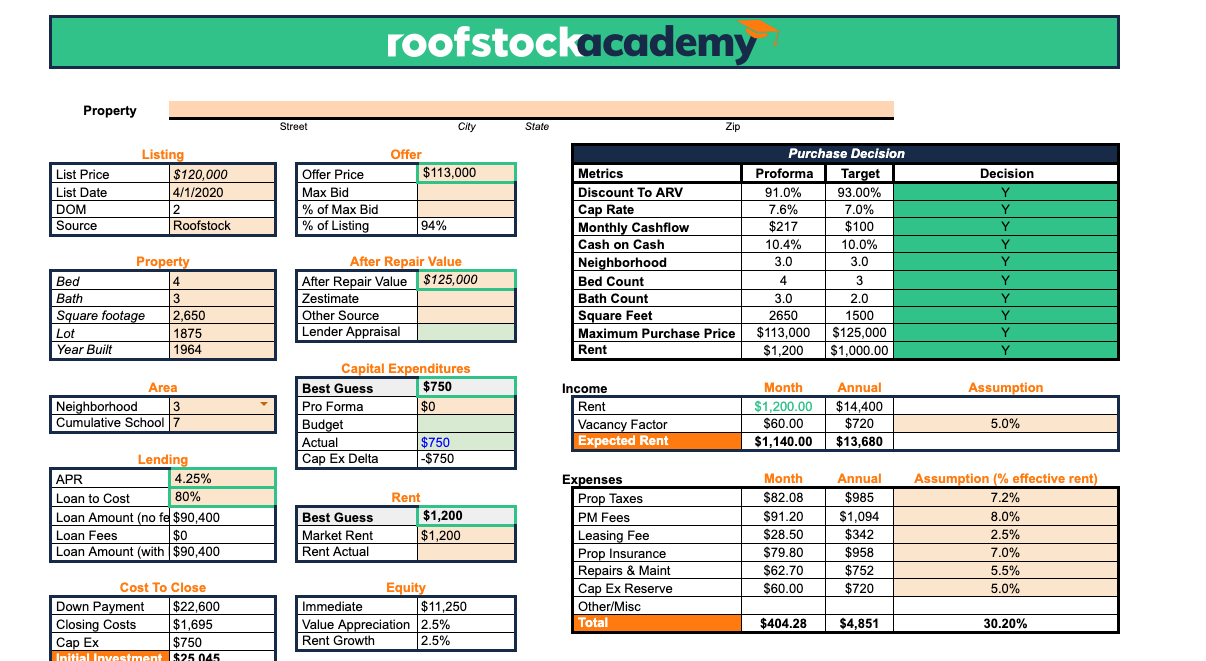

The rental property worksheet works on the income and the expenses regarding your property so that all the rent incurred from the rentals and also the expenditure can be added properly for the tax valuation.5 454 54 is the annual amount you can deduct when filing your rental property taxes.Here through this worksheet you will be able to manage each property monthly and calculate easily tax deduction base on profit and loss.

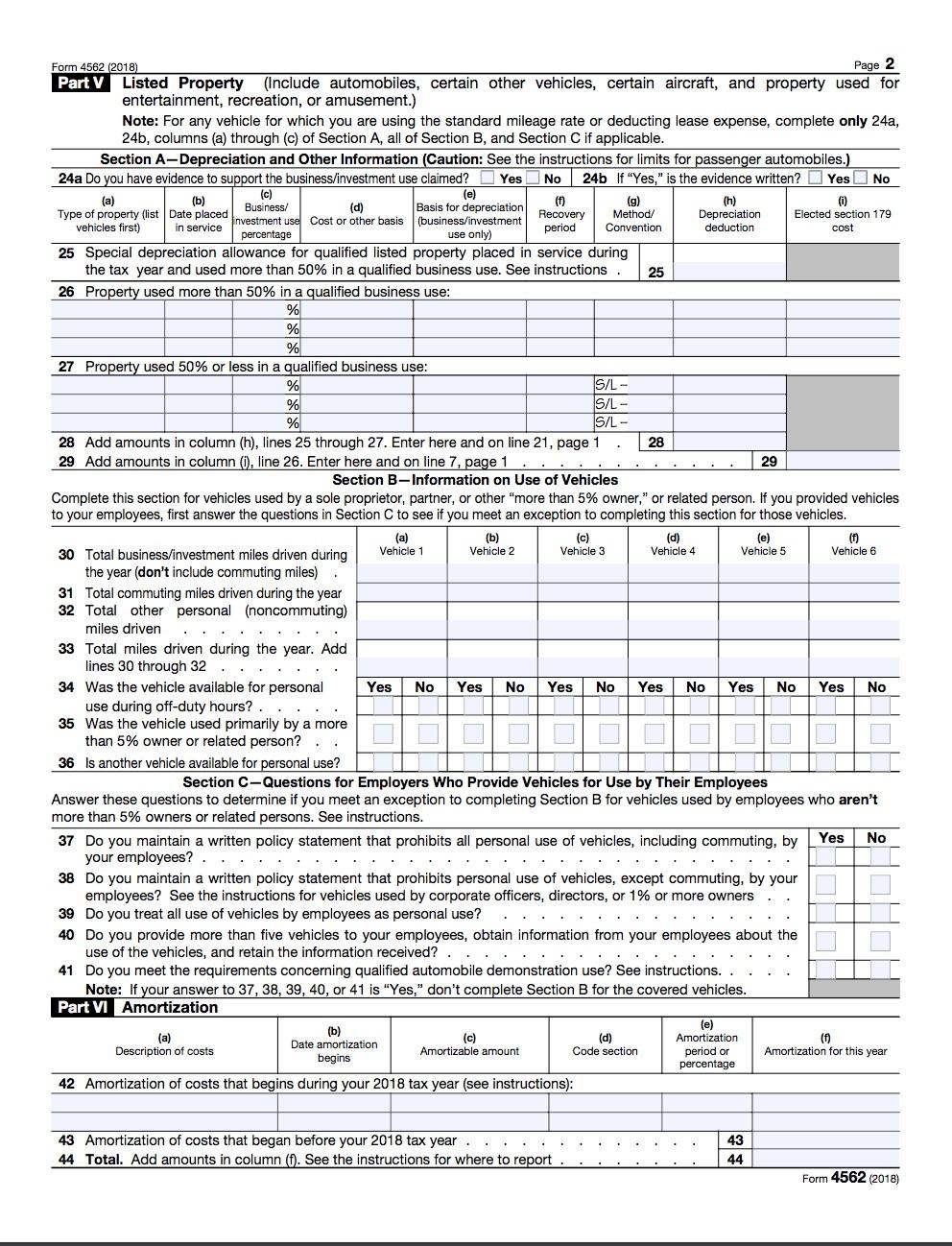

5 free rental property tax deductions worksheets rental property tax deductions worksheet is a document that manages your tax deduction on rental property.Rent reduction city of toronto 20 per cent for rental residential properties in the multi residential property tax class or.Then you divide the building value by 27 5 years to get the amount of yearly depreciation.

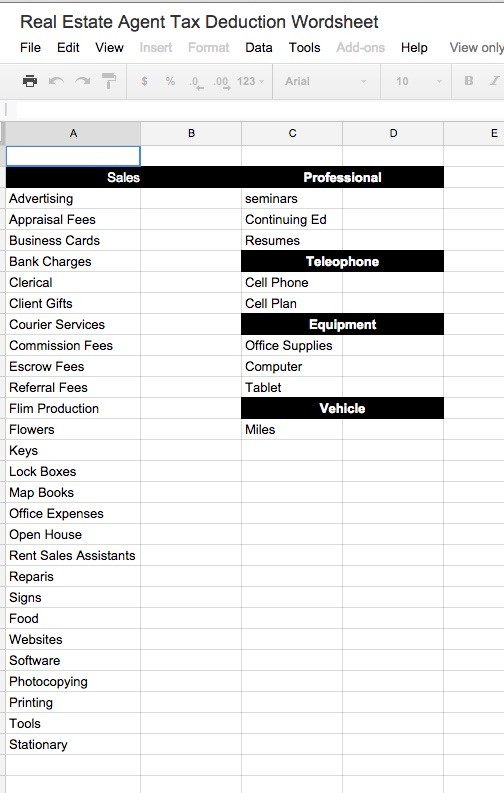

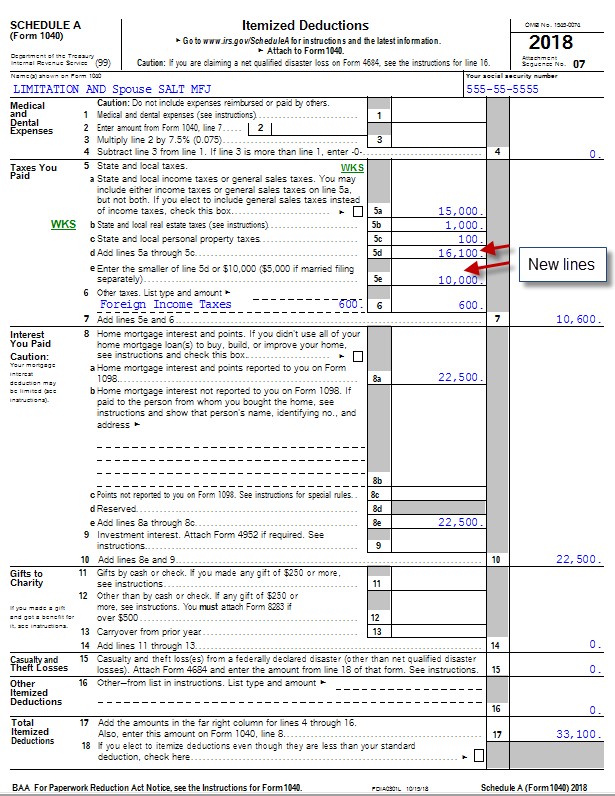

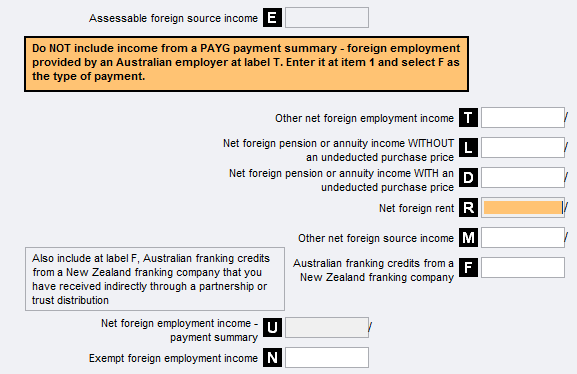

Rental property tax deductions worksheet accounting124 rental property tax deductions worksheet.For example you can deduct property taxes for the land and building where your rental property is situated.Rental income and expense worksheet to download the free rental income and expense worksheet template click the green button at the top of the page.

Advantages of rental property tax deductions worksheet such a lot of advantages are available of using tax deduction worksheet there are many individuals who are operating as a landlord on rental belongings within the shape of the rental property tax deductions worksheet.But if you have a net loss that can t be used as a deduction against your active income from your 9 5 job.Want to manage your rental property regarding tax system.

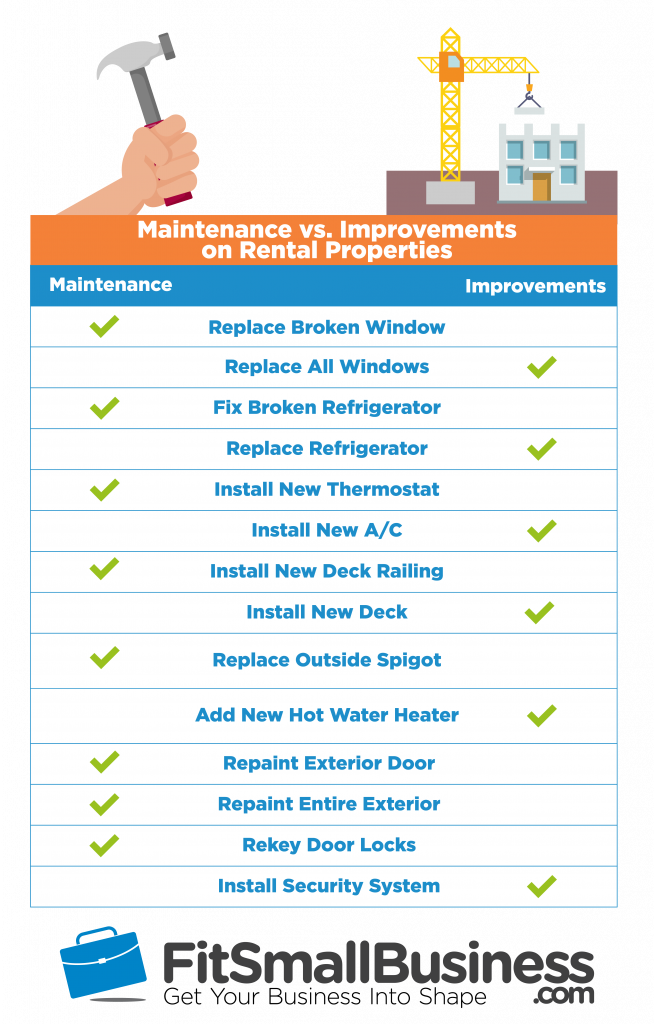

For more information go to vacant land and construction soft costs.Rental property deduction checklist.Rental expenses you can deduct canada ca you can deduct property taxes you incurred for your rental property for the period it was available for rent.

Track your rental finances by entering the relevant amounts into each itemized category such as rents and late fees in the rental income category or hoa dues gardening service and utilities in the monthly expense category.21 tax deductions for.150 000 27 5 5 454 54 depreciation per year.

300 000 150 000 150 000.