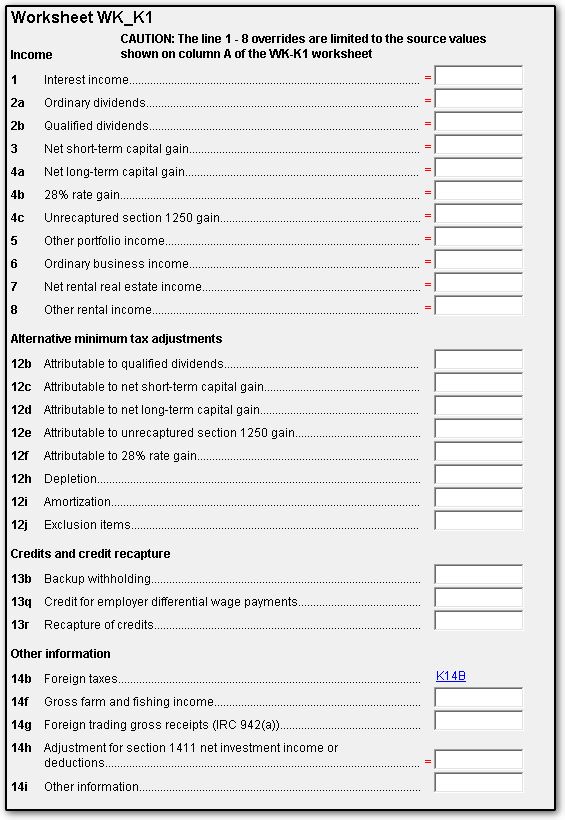

Capital Gains Tax Worksheet

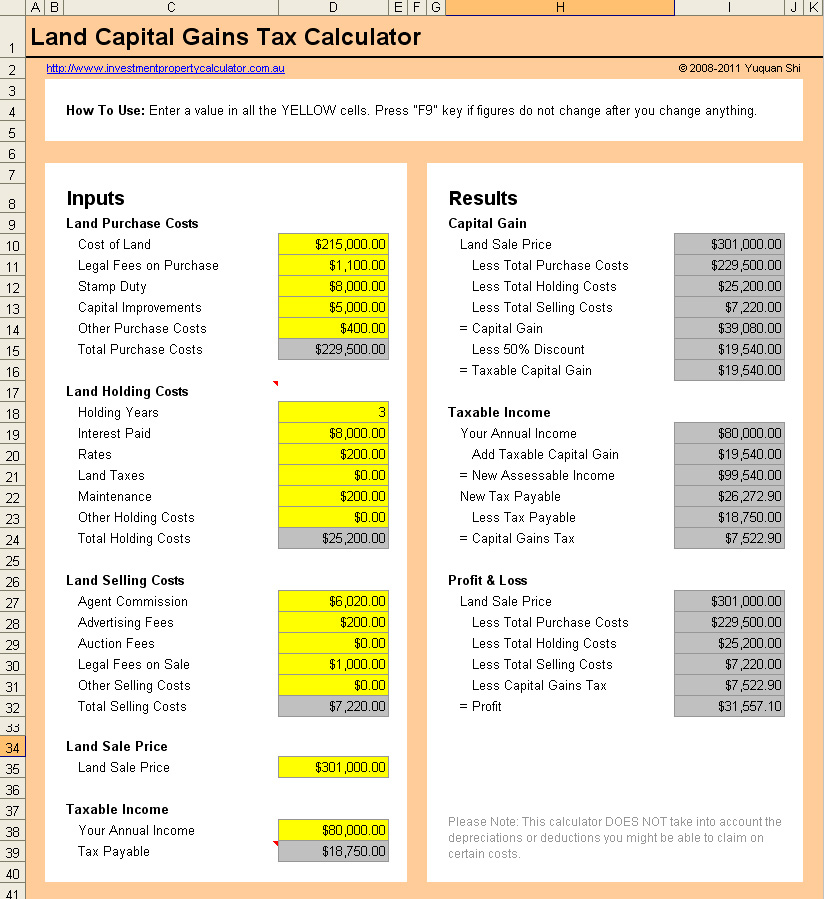

Simple capital gains worksheet.

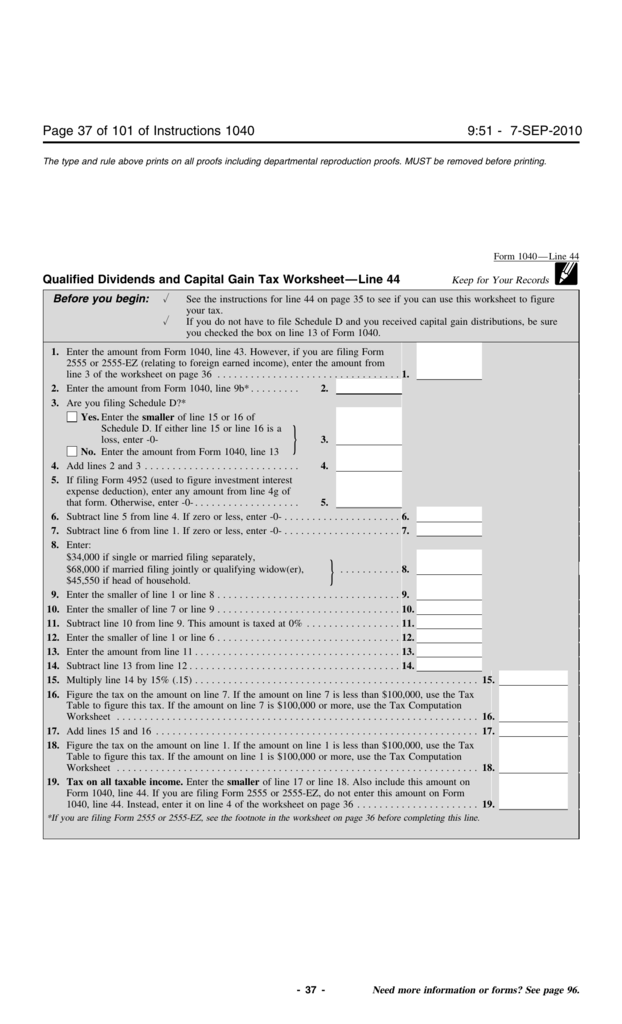

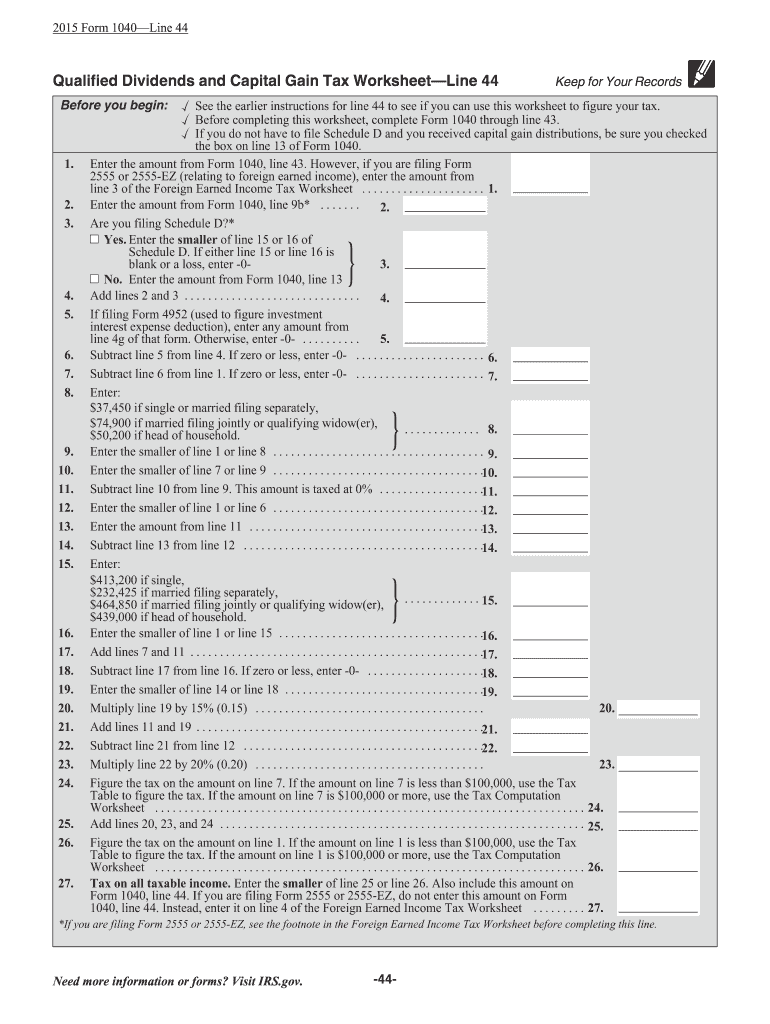

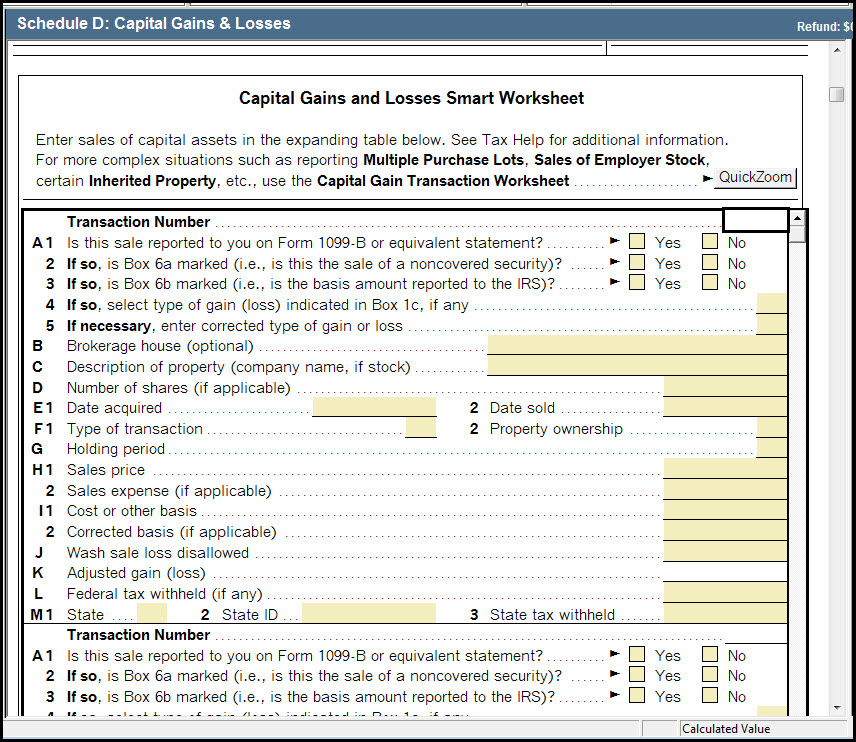

Capital gains tax worksheet.If you have investment income or investment expenses in any years from 1988 to 2019 you will also have to complete form t936 calculation of cumulative net investment loss cnil to december 31 2019.If the taxpayer does not have to file schedule d form 1040 and received capital gain distributions be sure the box on line 6 form 1040 is checked.2020 capital gains tax calculator see what you ll owe.

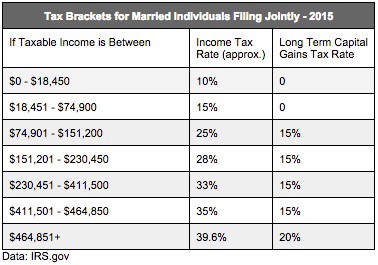

Stick to the fast guide to do form instructions 1040 schedule d steer clear of blunders along with furnish it in a timely manner.Depending on your regular income tax bracket your tax rate for long term capital gains could be as low as 0.Capital gains worksheet for shares.

Capital gains tax calculation worksheet the balance we are going to build a worksheet to calculate capital gains.Worksheet for capital gains and losses.Capital gains worksheet for xyz stock.

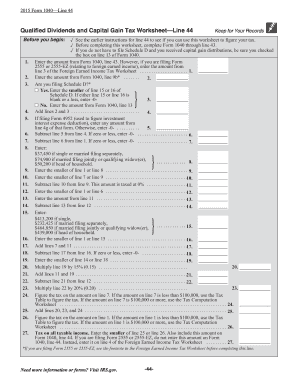

Before completing this worksheet complete form 1040 or 1040 sr through line 11b.Iowa capital gains worksheet.Instead they are included on form 1099 div as ordinary divi dends.

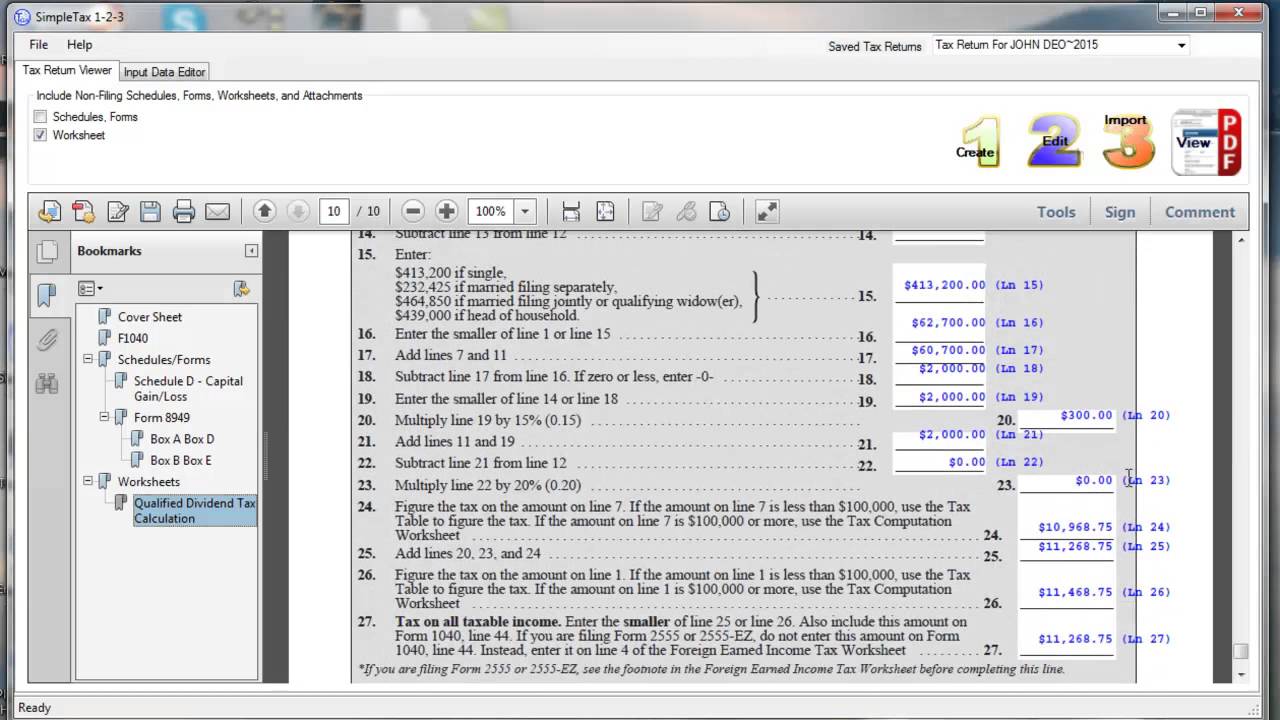

Qualified dividends and capital gain tax worksheet 2020.That s why some very rich americans don t pay as much in taxes as you might expect.Qualified dividends and capital gain tax worksheet 2020 2020 online solutions help you to manage your record administration along with raise the efficiency of the workflows.

One goal is to see how the math works.Qualified dividends and capital gain tax worksheet 2018 qualified dividends and capital gain tax worksheet.Even taxpayers in the top income tax bracket pay long term capital gains rates that are nearly half of their income tax rates.

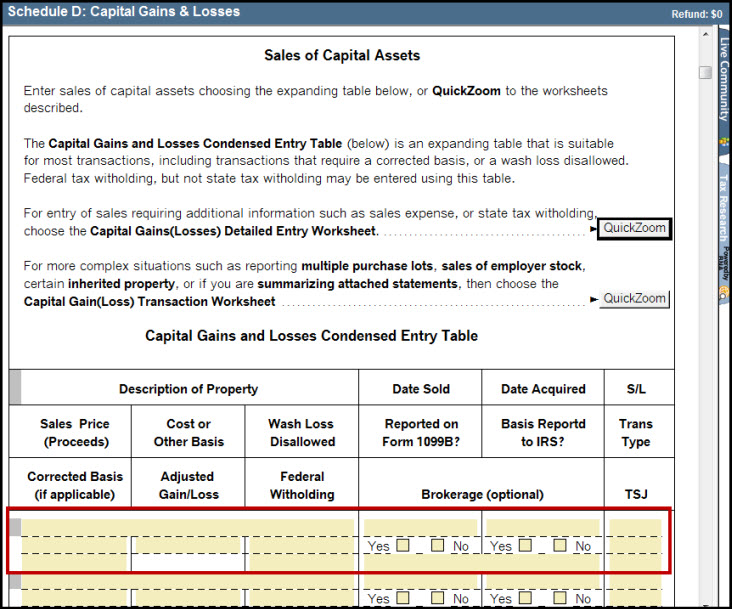

Gains from involuntary conversions other than from casualty or theft of capital assets not held for business or profit.See before completing this worksheet complete form 1040 through line 11b.About schedule d form 1040 or 1040 sr capital gains and losses use schedule d form 1040 or 1040 sr to report the following.

Distributions of net realized short term capital gains aren t treated as capital gains.Qualified dividends and capital gain tax worksheet 2019 qualified dividends and capital gain tax worksheet 2019 form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer s tax.Enter on schedule d line 13 the to tal capital gain distributions paid to you during the year regardless of how long you held your investment.

Qualified dividends and capital gain tax worksheet qualified dividends and capital gain tax worksheet.About schedule d form 1040 or 1040 sr capital gains and.And losses capital gains from its net realized long term capital gains.

If you do not have to file schedule d and you received capital gain distributions be sure you checked the box.Capital gains 2019 canada ca use form t657 calculation of capital gains deduction for 2019 to calculate the capital gains deduction.Qualified dividends and capital gain tax worksheet form 1040 instructions html.

Hawaii capital gains tax worksheet.A second goal is to show you how to organize your investment data for tax purposes.Shares share on facebook.

Capital gains tax computation worksheet worksheet.Taxwise capital gains worksheet.28 percent capital gains worksheet.

The sale or exchange of a capital asset not reported on another form or schedule.Capital gains dividend worksheet.

/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)

/GettyImages-110052232-5a4c377647c26600369f97a0.jpg)

/ScheduleD-CapitalGainsandLosses-1-d651471c24974ac79739e2ef580b1c35.png)