Home Office Deduction Worksheet

Home office deduction worksheet bastian accounting for.

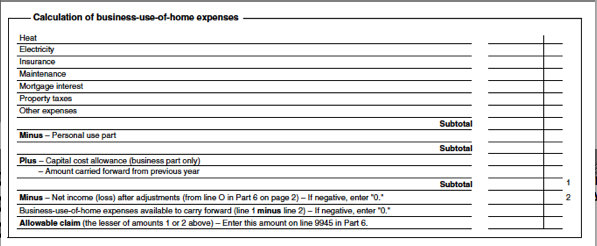

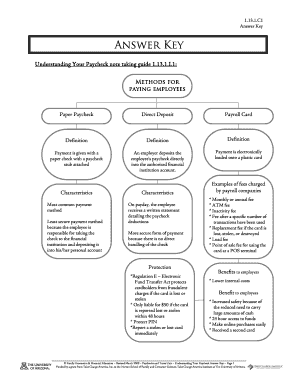

Home office deduction worksheet.Most of the information here will change every year except for the business percentage and the section related to depreciation.Enter the lower amount of line 24 or 25 of form t777 at line 9945.Home office deduction internal revenue service the home office deduction is available for homeowners and renters and applies to all types of homes.

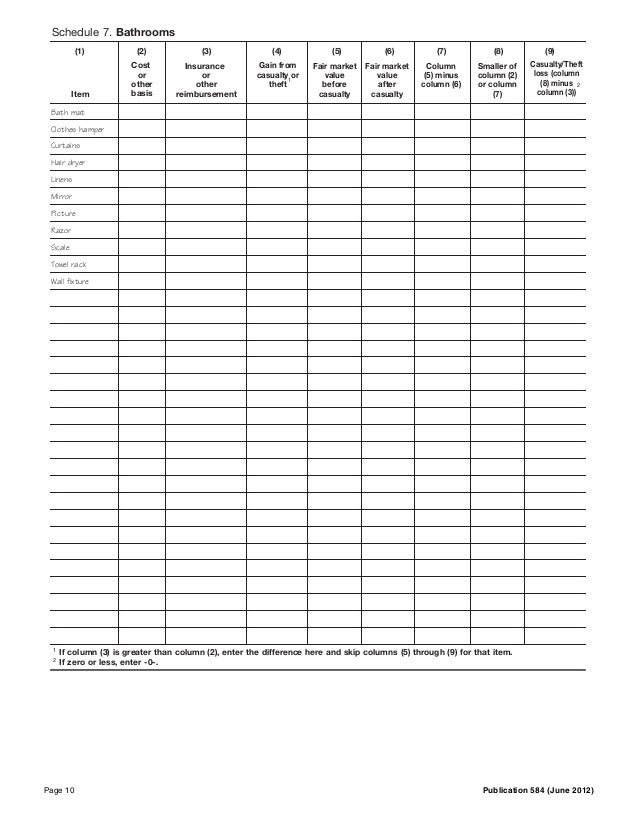

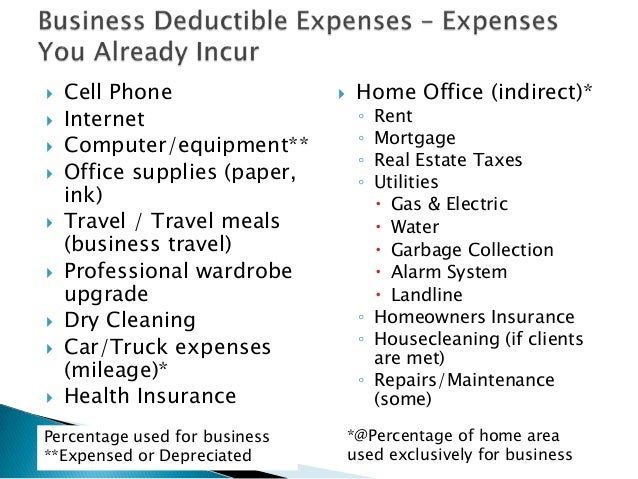

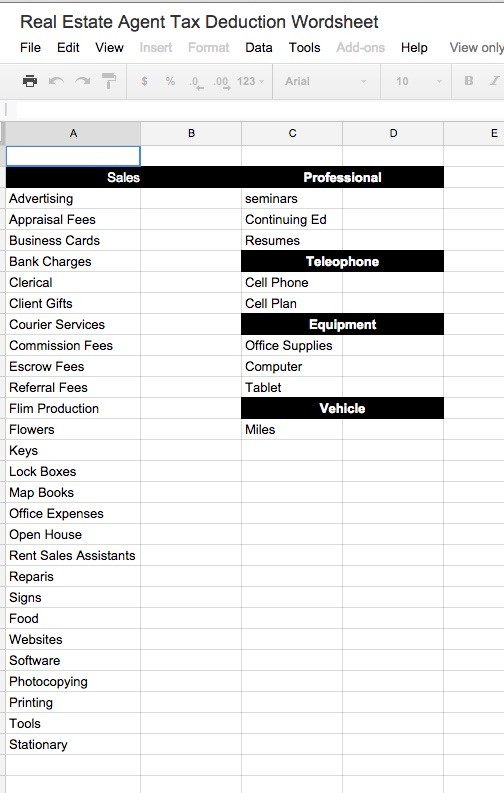

Home office deductions for self employed and employed.Examples include your utility bills mortgage interest or rent insurance hoa real estate taxes repairs pest control trash removal security and maintenance.Home office deduction worksheet.

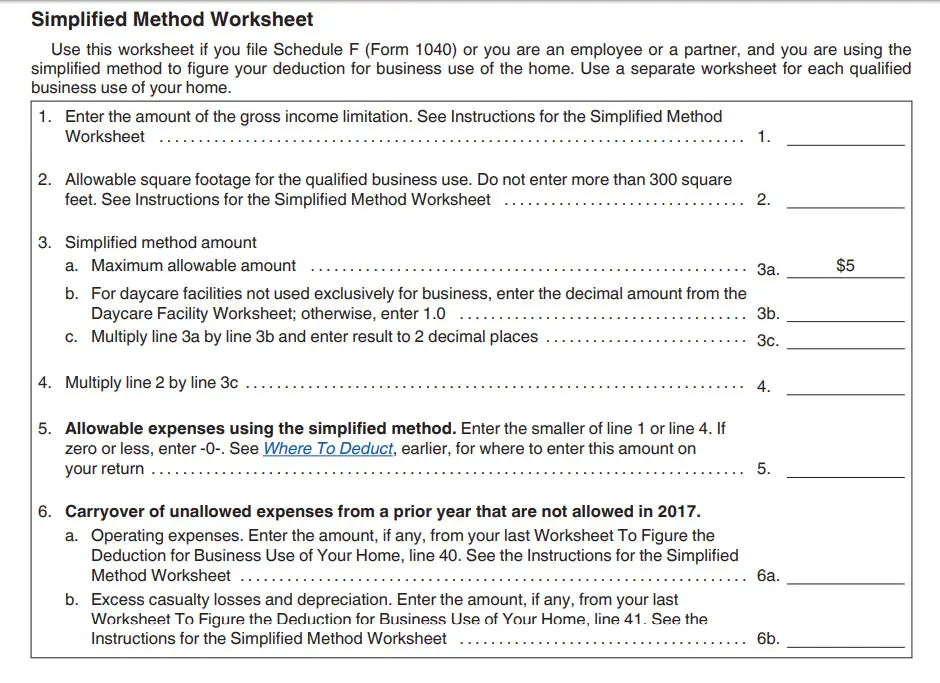

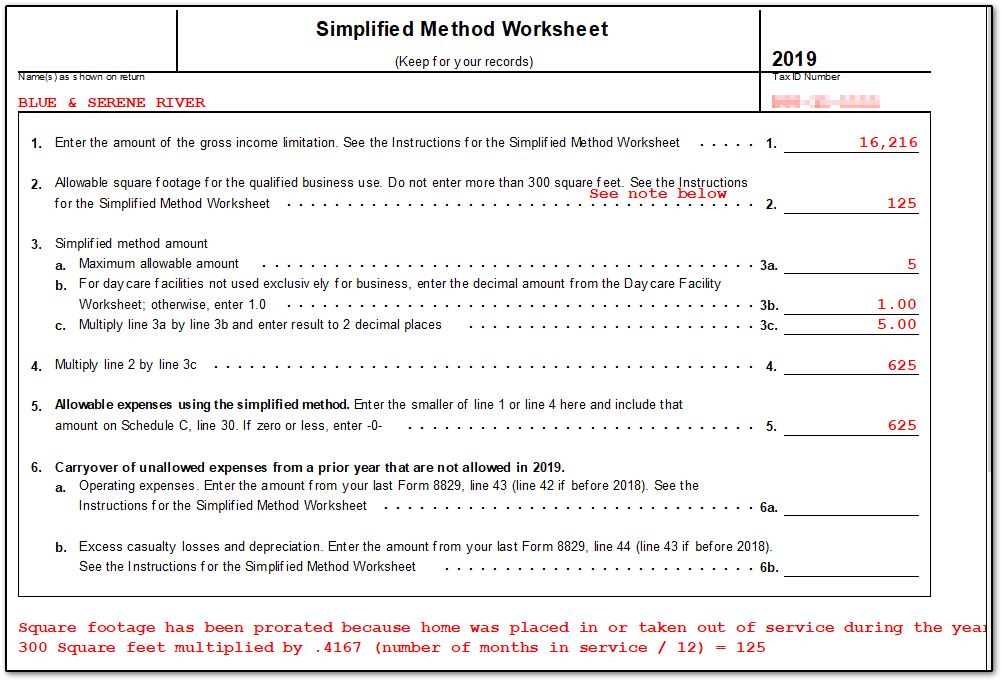

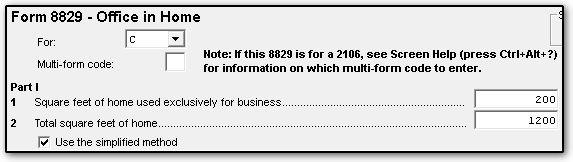

Simplified option for taxable years starting on or after january 1 2013 filed beginning in 2014 you now have a simplified option for computing the home office deduction irs revenue procedure 2013 13 january 15 2013.A fillable pdf what you are viewing now and an online digital form.Enter on line 22900 the allowable amount of your employment expenses from the total expenses line of form t777.

The irs has a set rate for the simplified method of 5 per square foot.Work space in the home expenses canada ca if your office space is in a rented house or apartment where you live deduct the percentage of the rent as well as any maintenance costs you paid that relates to the work space.504 780 0456 2901 houma blvd suite 2 fx.

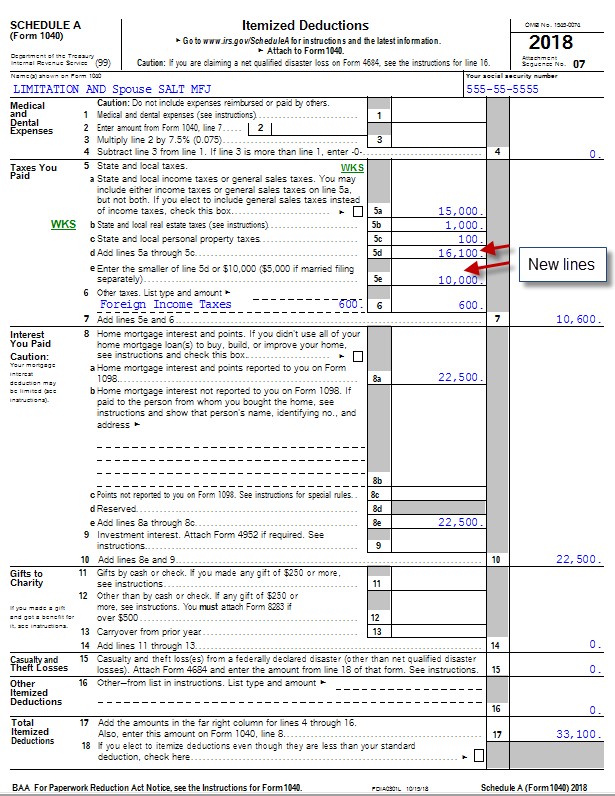

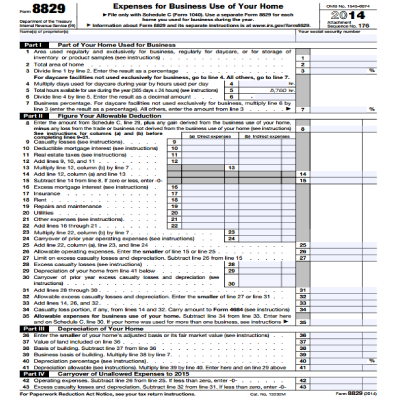

Generally you cannot deduct items related to your home such as mortgage interest real estate taxes utilities.Home office deduction michele cagan cpa worksheet 2.To deduct expenses for the business use of your home.

Indirect expenses are required for keeping up and running your entire home.In order to take full advantage of the home office deduction the space must be used.The simplified method is super simple.

The amount you can deduct for work space in the home expenses is limited to the amount of employment income remaining after all other employment expenses have been deducted.Home office deduction worksheet keystone cpa inc.Qualifying for a deduction.

The information will go on irs form 8829 which feeds into schedule c.Home office deduction use this worksheet to figure out your full home office deduction.Worksheets to figure the deduction for business use of your home simplified method.

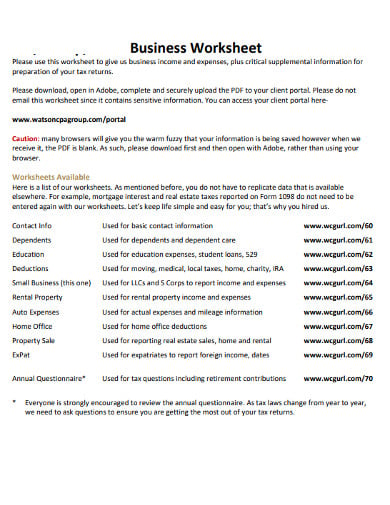

Home office deduction worksheet wcg cpas home office deduction worksheet please use this worksheet to give us information about your home office for preparation of your tax returns.Home office deduction worksheet.To determine how much you can deduct for your home office expenses calculate the size of your office as a percentage of your home s total size.

Executive tax service llc phone.It must be your principal place of business for your trade or business the area you use is used exclusively and regularly and for no other purpose than your business you have no other fixed location where you.The simplified method will allow us a 500 home office deduction with no record keeping or receipts or depreciation required on a hundred square foot home office.

There are two versions of this worksheet.For example if your home is 1 500 square meters and your office is 300 square meters your office is 20 of your home s total size which means you are able to deduct 20 of many home expenses as home office expenses on your tax return.

/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg)