Affordable Care Act Worksheet

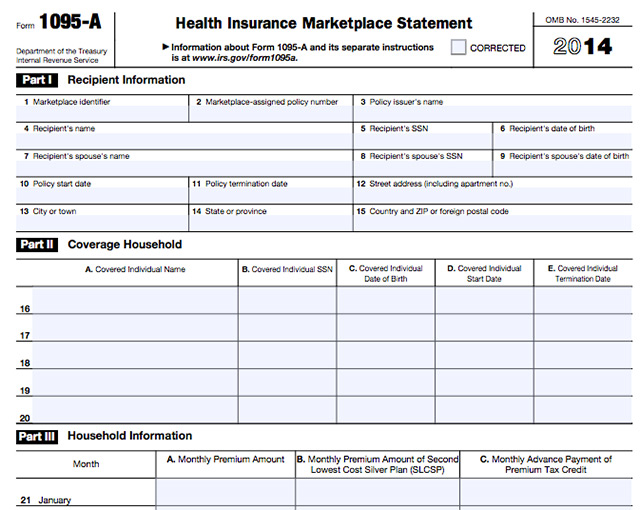

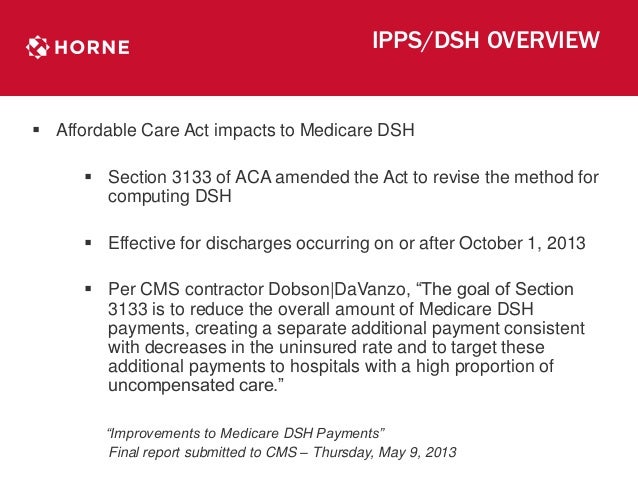

These tax provisions contain important changes including how individuals and families file their taxes.

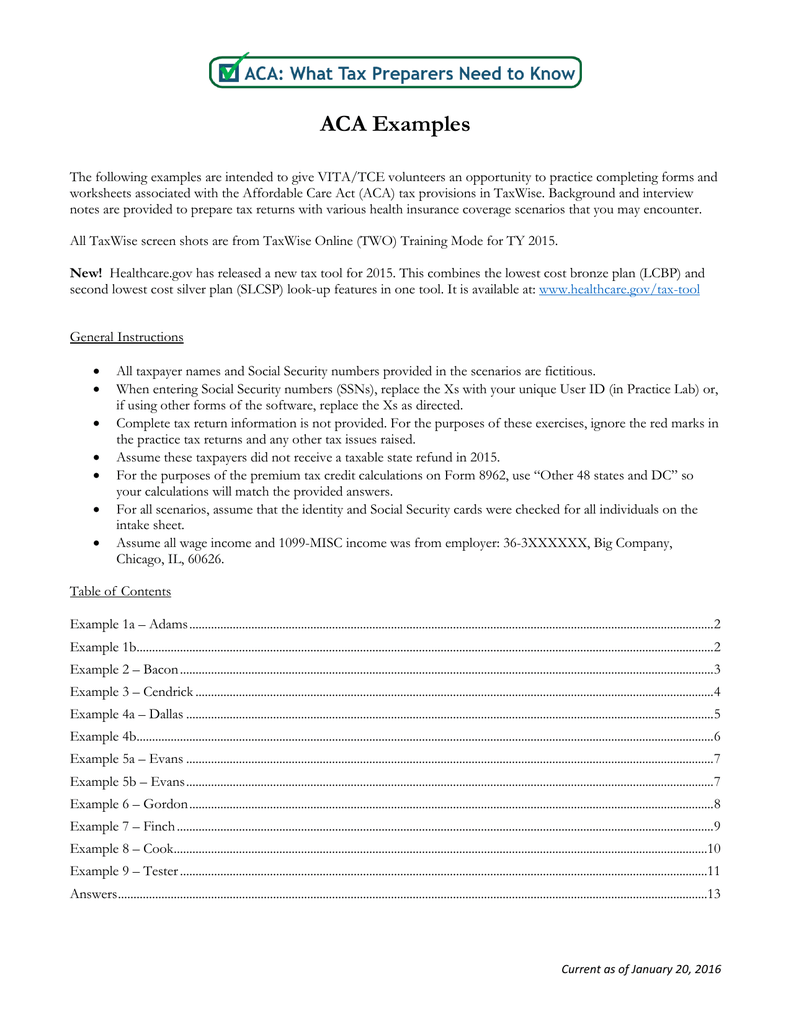

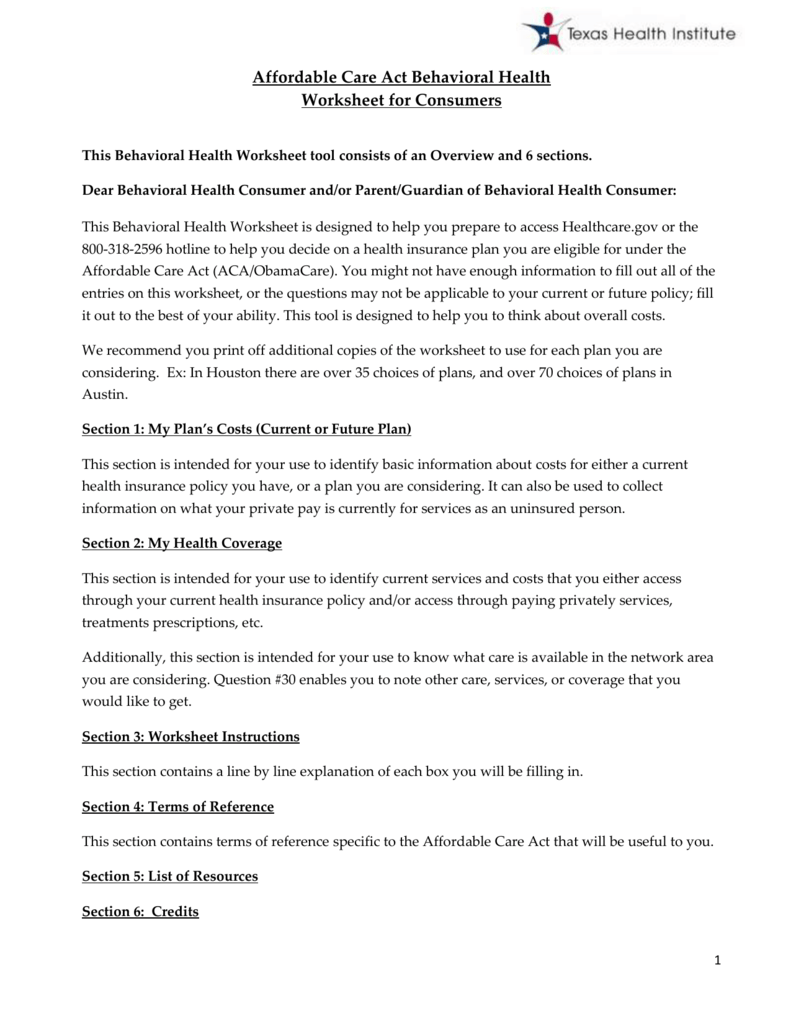

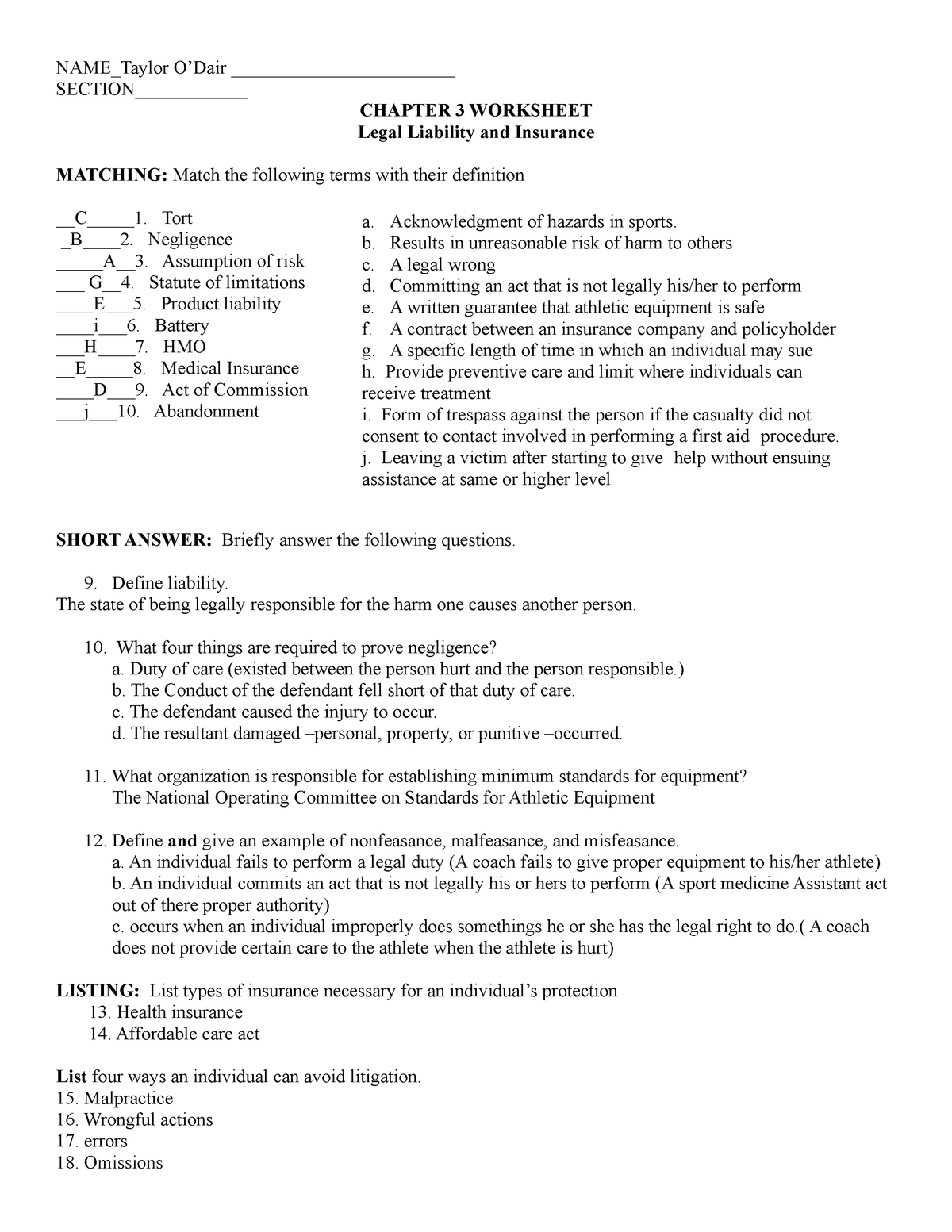

Affordable care act worksheet.Some of the worksheets for this concept are affordable care act work volunteer income tax assistance vita tax counseling affordable care act aca affordable care act how health insurance works affordable care act aca resources affordable care act key small business provisions 2018 instructions for schedule h form 990.Affordable care act affordable care act.You will learn how to deter mine if taxpayers are eligible to receive the premium tax credit.

Affordable care act worksheets teaching resources tpt this is a short current events lesson designed to create discussion about the affordable care act more commonly known as obamacare.This lesson covers some of the tax provisions of the affordable care act aca.We know that the affordable care act aca is confusing and it may be difficult to understand how it affects you and or your business.

Affordable care act worksheet awesome affordable care act.Created on 28 september 2013 this lesson focuses on the congressional debate over legislation that would de fund obamacare but would avert a government shutdown.Individual shared responsibility provision internal.

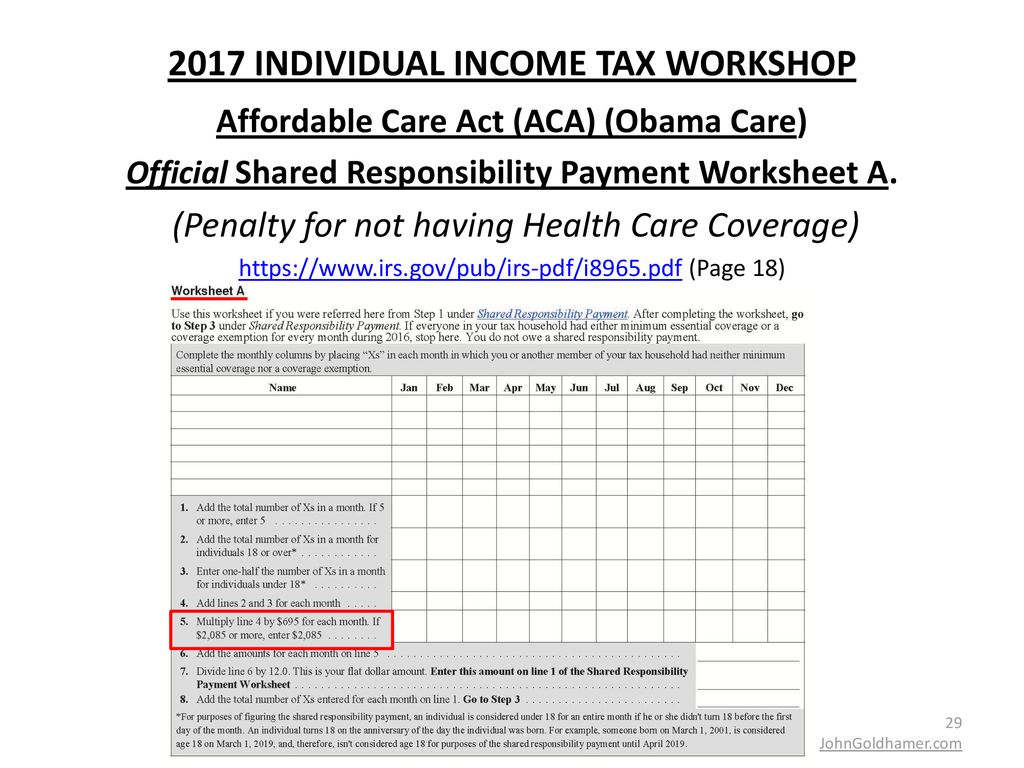

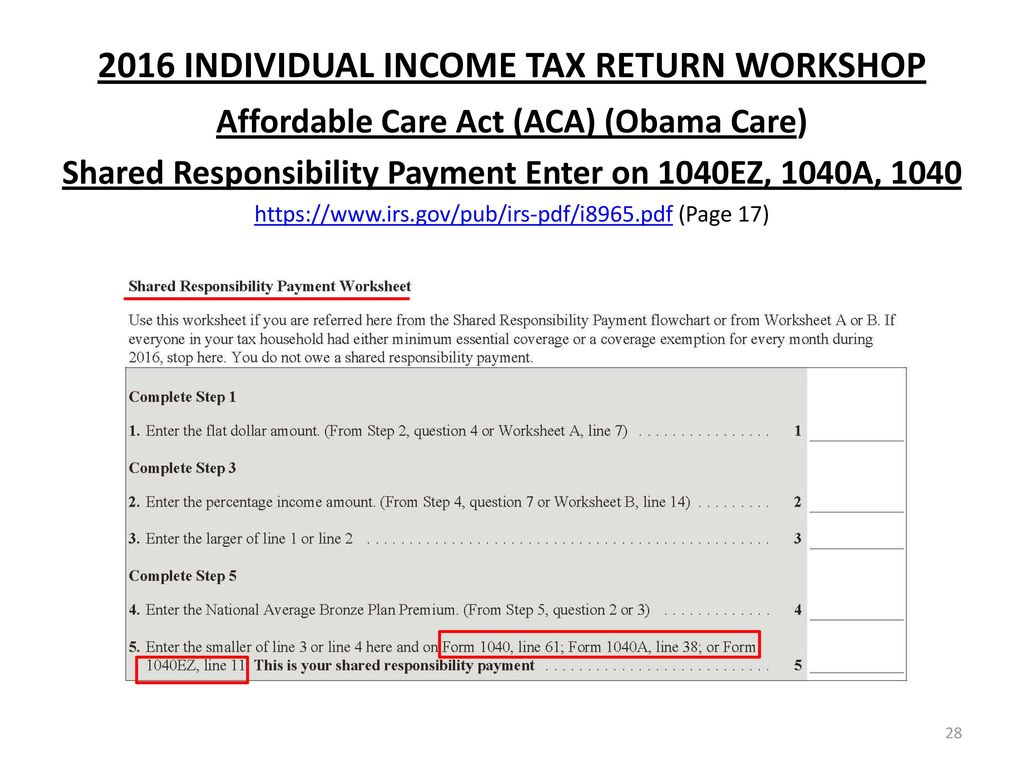

Affordable care act estimator tools internal revenue service legal guidance and other resources.Once you find your worksheet click on pop out icon or print icon to worksheet to print or download.For the 2019 tax year the individual shared responsibility payment srp is reduced to zero.

Beginning with the 2019 tax year for which tax returns are filed in early 2020 the shared responsibility payment or penalty for not having minimum essential health coverage no longer applies.Jun 11 2020 affordable care act worksheet 50 affordable care act worksheet new 2019 affordable care act guidelines and their effects.As a result a taxpayer who does not have health coverage in 2019 or later does not need an exemption to avoid the penalty and affordability worksheet is not in the tax program in for tax years after 2018.

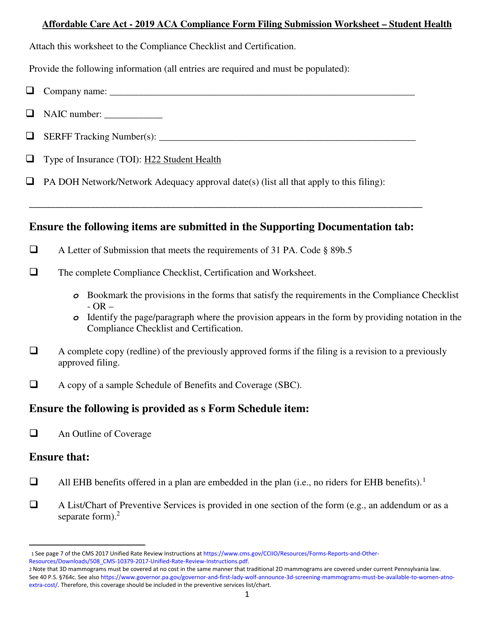

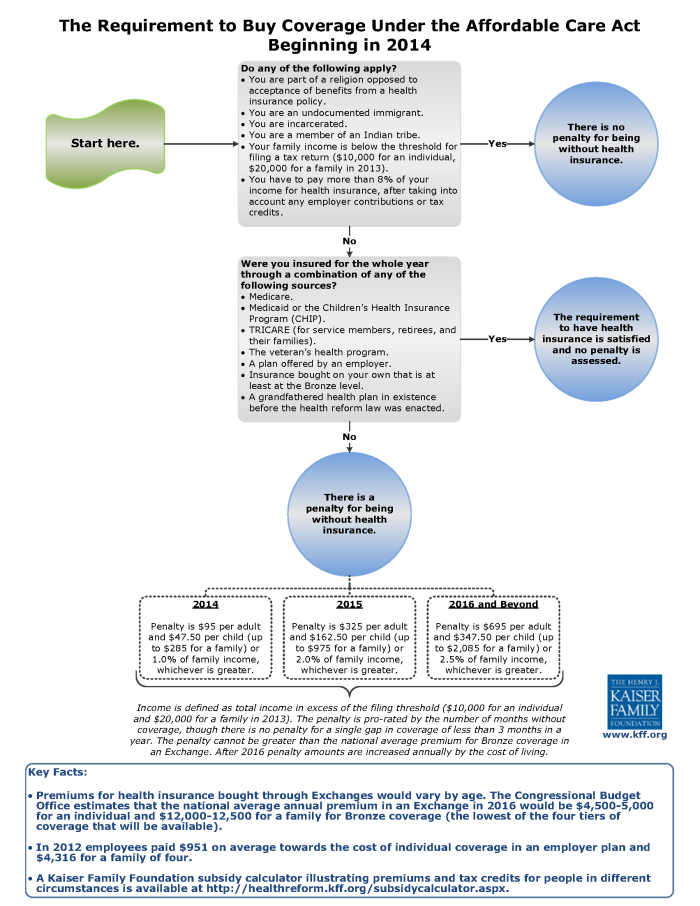

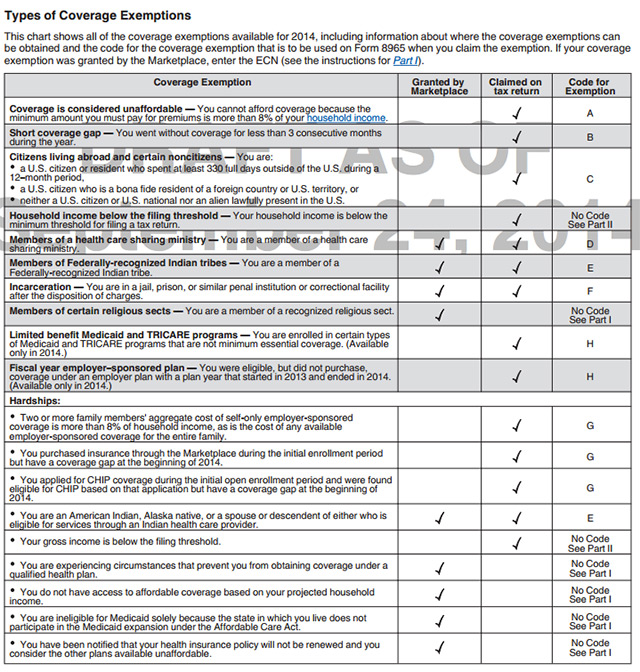

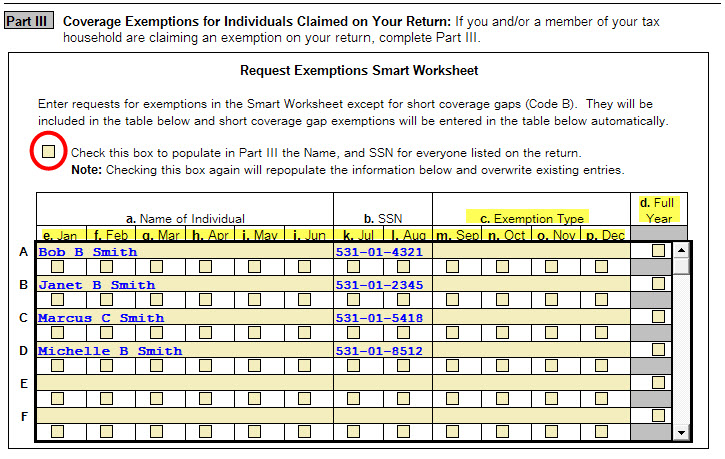

The law also contains benefits and responsibilities for other organizations and employers.Have qualifying health coverage called minimum essential coverage qualify for a health coverage exemption make a shared responsibility payment with their federal income tax return for the months that without coverage or an exemption.Affordable care act worksheets learny kids some of the worksheets for this concept are affordable care act work volunteer income tax assistance vita tax counseling affordable care act aca affordable care act how health insurance works affordable care act aca resources affordable care act key small business provisions 2018 instructions for schedule h form 990.

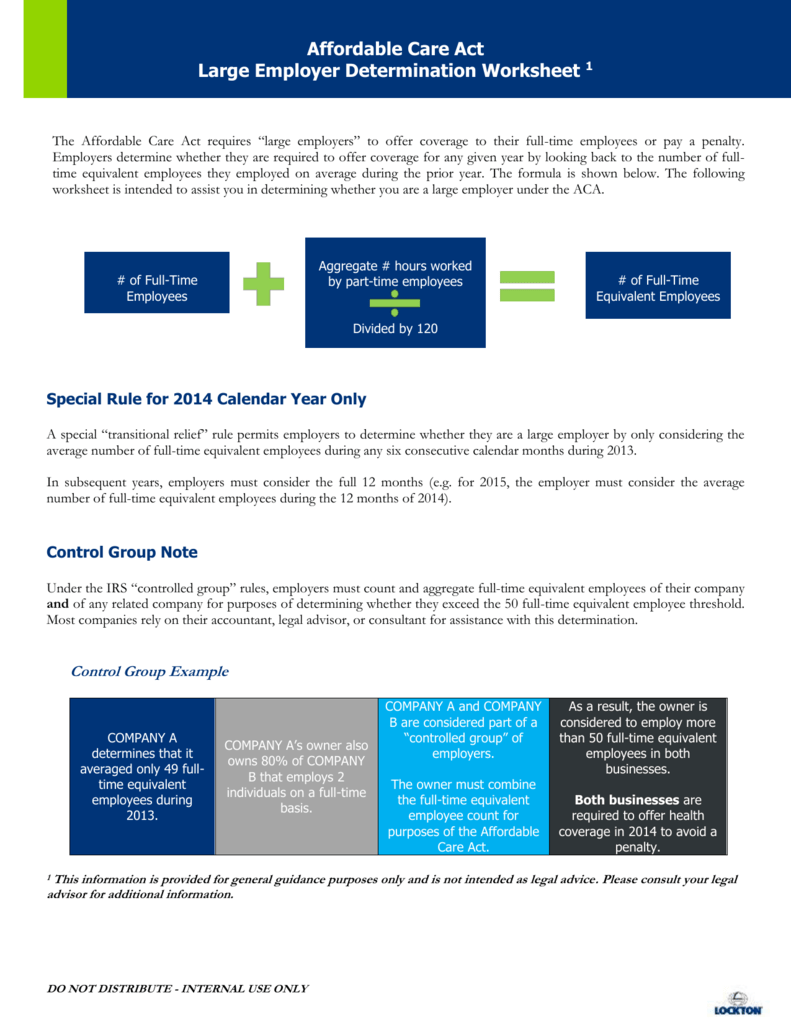

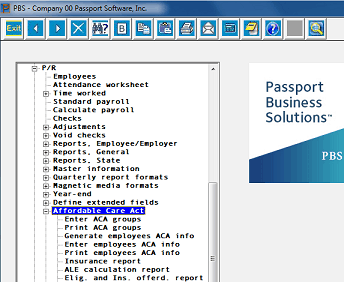

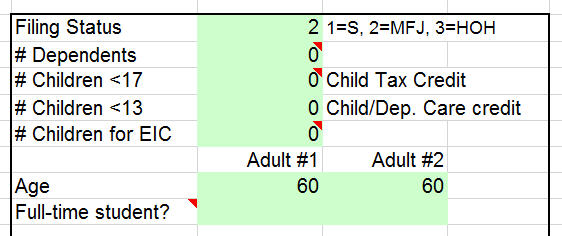

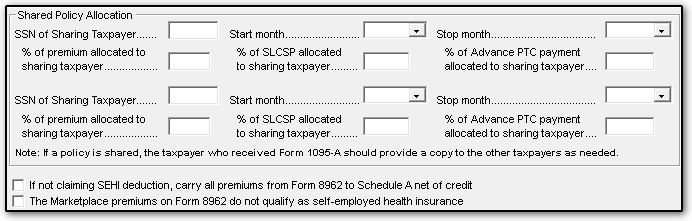

For tax year 2019 returns under the tax cuts and jobs act.Under the recently enacted tax cuts and jobs act taxpayers must continue to report coverage qualify for an exemption or pay the individual shared responsibility payment for tax years 2017 and 2018.To offer our clients additional assistance we have created the affordable care act worksheet to assist you in calculating full time and full time equivalent fte employees.

The taxpayer advocate service has developed several tools for individuals and employers to help determine how the affordable care act might affect them and to estimate aca related credits and payments.Affordable care act worksheets kiddy math affordable care act displaying top 8 worksheets found for this concept.Affordable care act worksheet resource article cordell.

A list of terms you may need to know is included at the end of the lesson.Affordable care act worksheet.