Clothing Donation Tax Deduction Worksheet

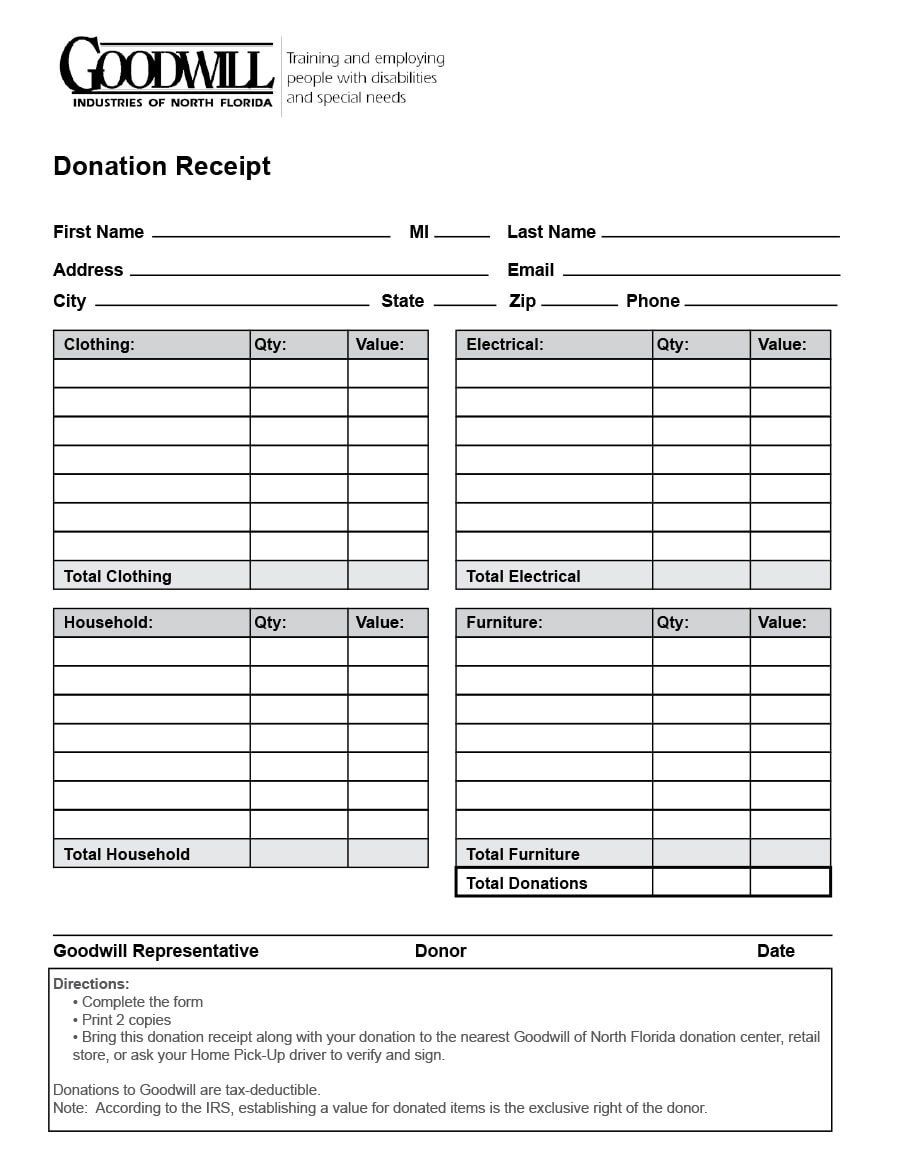

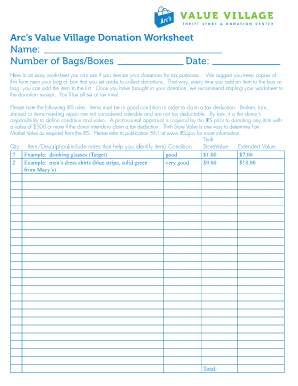

The goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on your taxes.

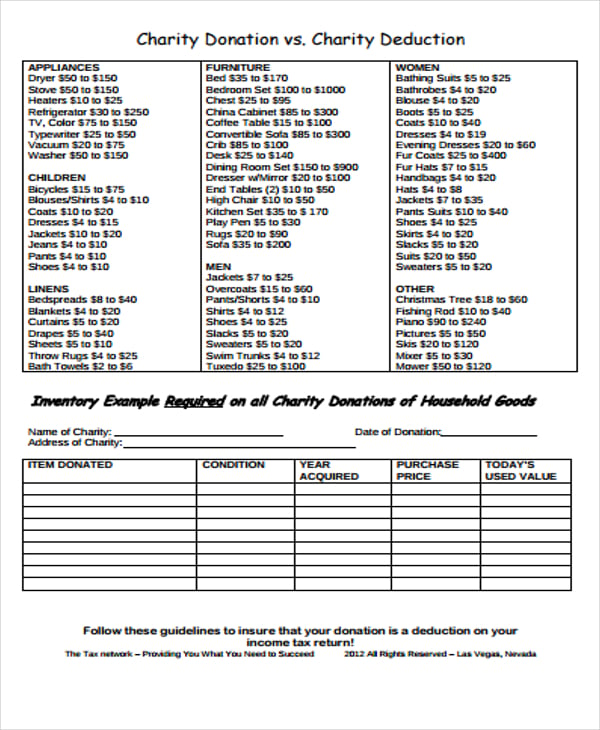

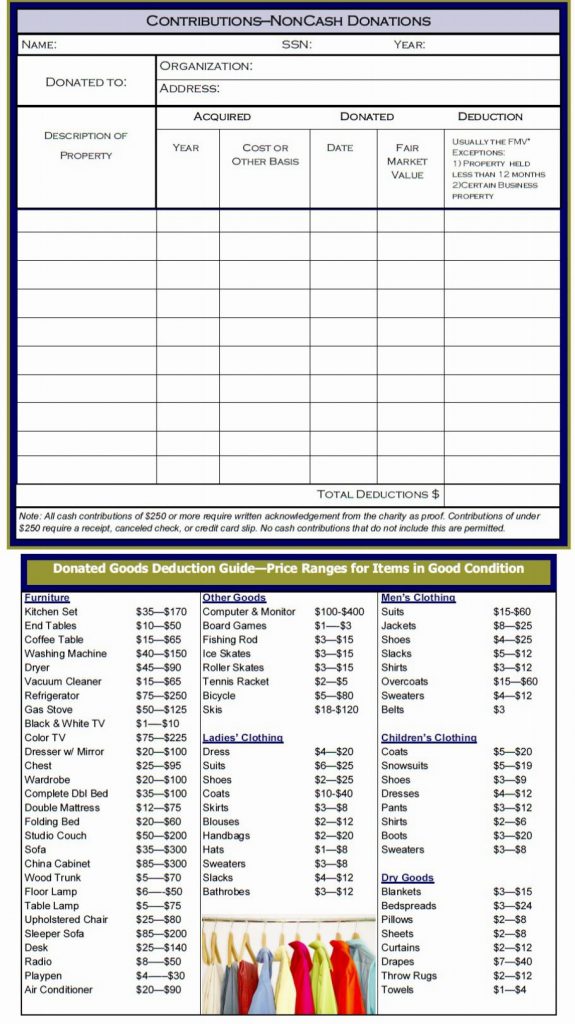

Clothing donation tax deduction worksheet.Donation value guide for 2020 the balance you can request a statement of value from the irs if you re donating anything that s extremely valuable worth 50 000 or more but it will cost you 6 500 for one to three items and 300 each for every item over three.Free goodwill donation receipt template pdf eforms.Your receipts should include a reasonably accurate description of items donated.

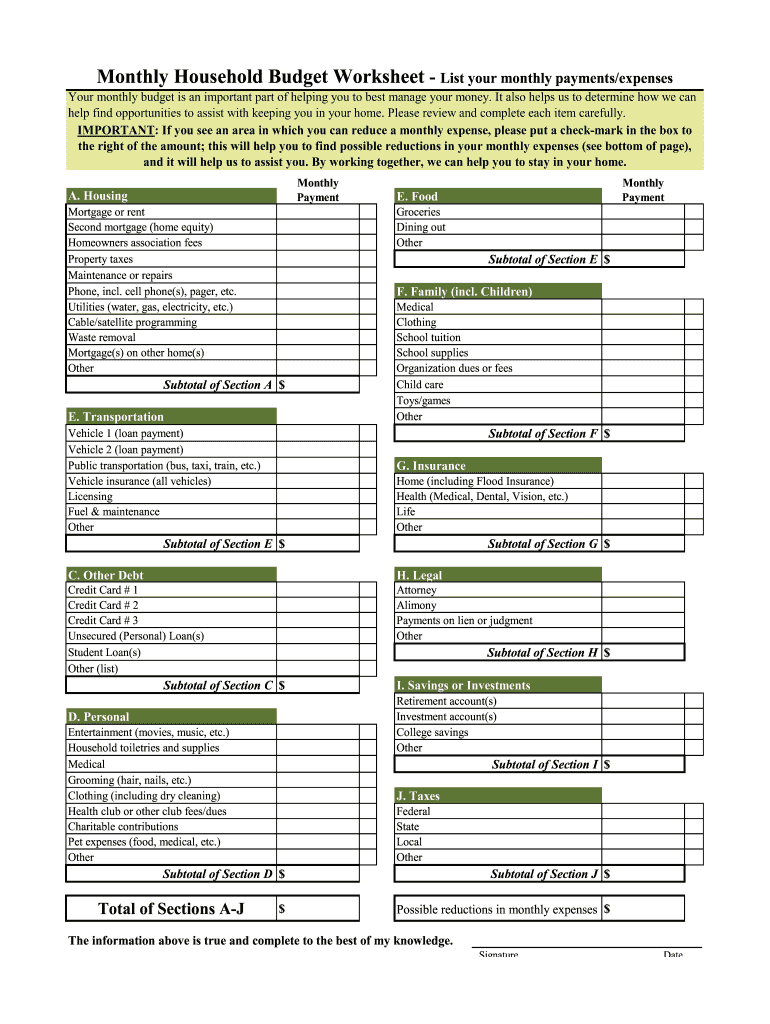

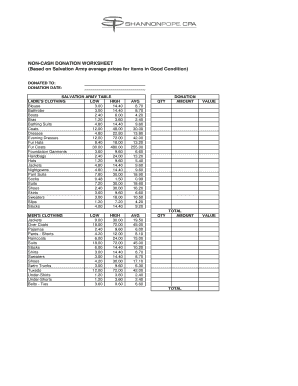

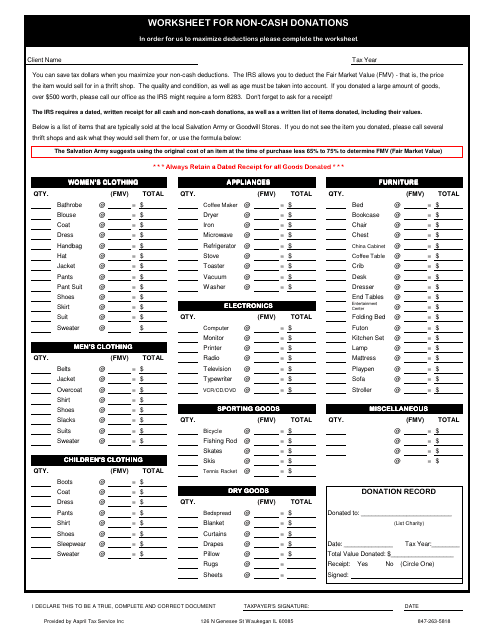

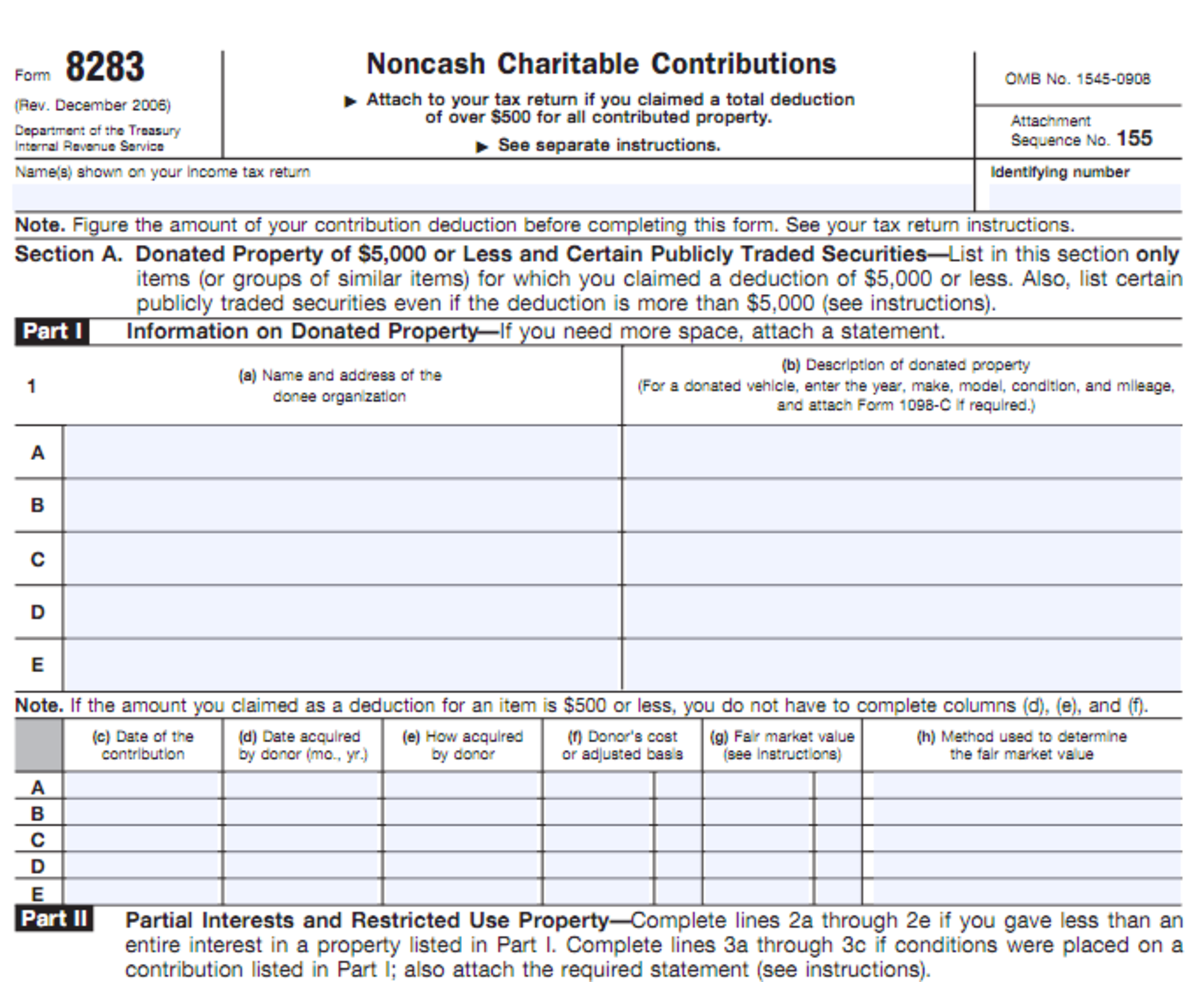

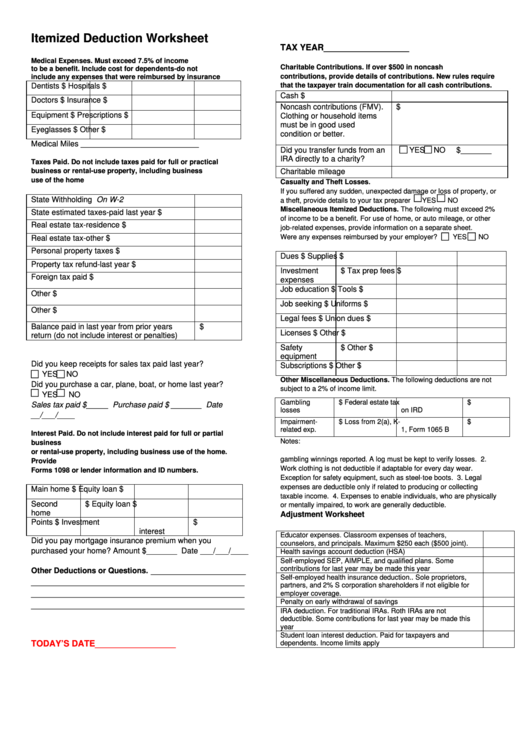

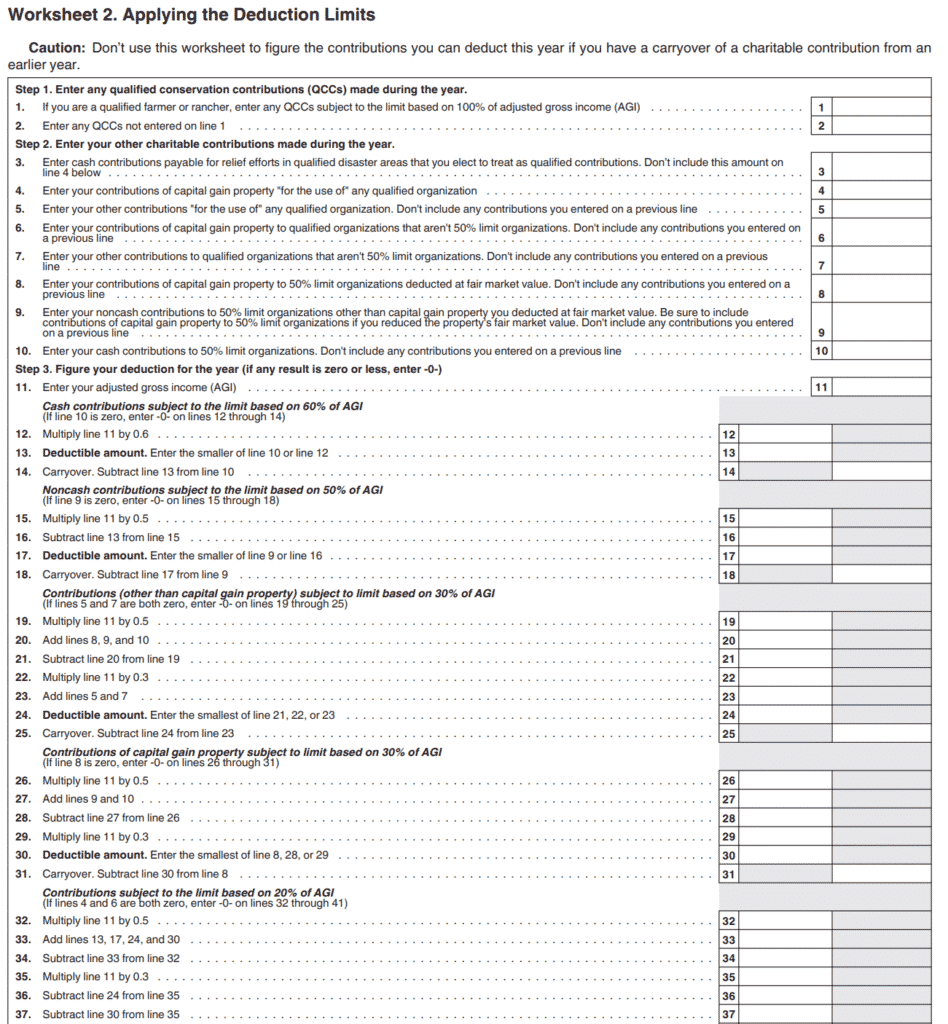

Noncash charitable deductions worksheet.Insert tax year insert date given enter items not provided for in the above categories.One should prepare a list for each separate entity and date donations are made.

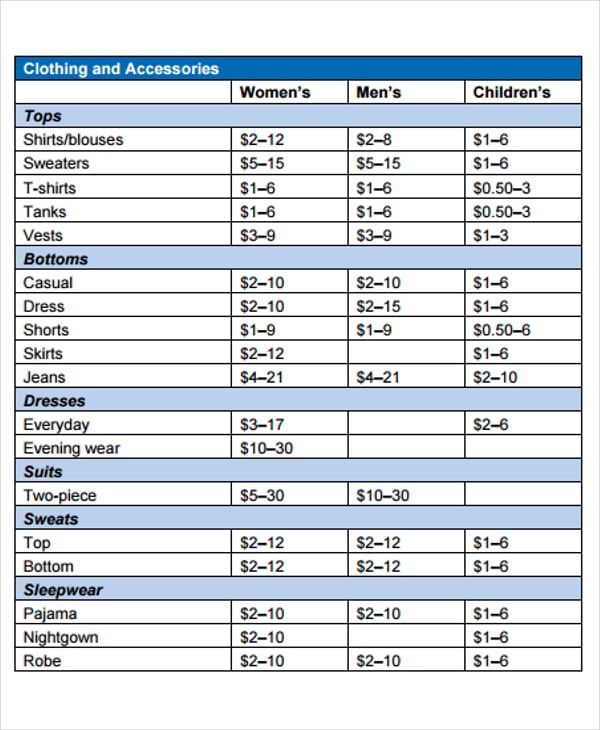

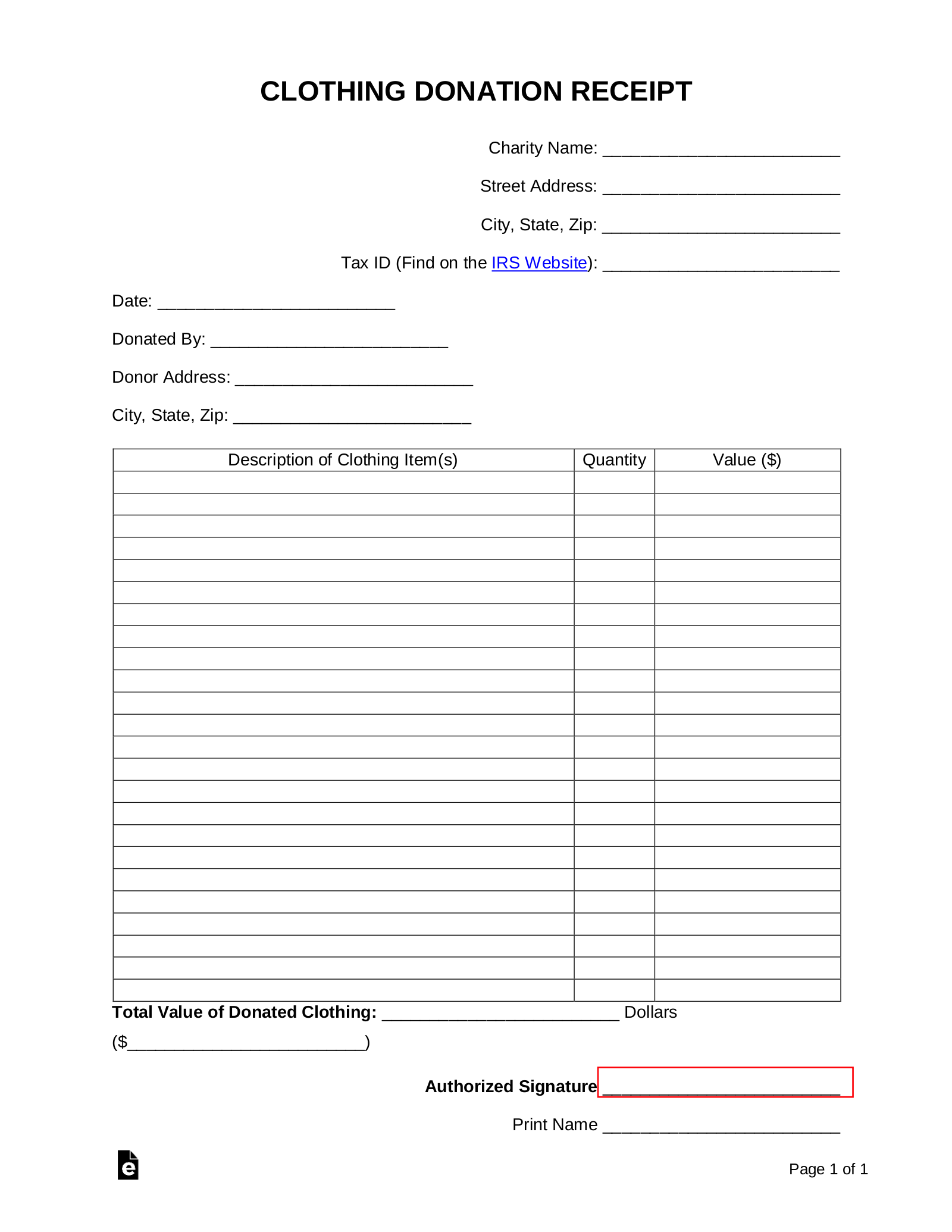

Use this donation valuation guide to get a good idea as to appraising your items.A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim as a deduction against their state and or federal taxes.Standard guidelines such as a fixed percentage of an item s original value can help to ensure that these figures are accurate and do not raise suspicions when filing one s tax returns.

Noncash charitable deductions worksheet.If one made a donation on.Online donation value guide spreadsheet printable and.

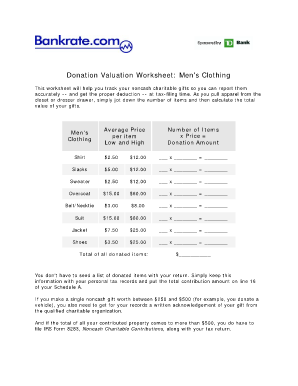

Item s average price per item low average price per item high number of items x price donation amount.Make certain that you click the link make a replica of the pre filled google sheet for editing.Clothing donation tax deduction worksheet related content publication 561 4 2007 determining the value of donated property.

Men s clothing children s clothing quantity good excellent total total of all donated items entity to whom donated.Donation valuation guide tax deductions for donated.If you put a restriction on the use of property you donate the fmv must.

Likewise sweat shirts pants my our best guess of value non cash charitable contributions donations worksheet.Non cash charitable contributions donations worksheet retain this worksheet with your receipts in your tax file.The donor you is responsible for valuing the donated items and it s important not to abuse and overvalue items in the event that you are audited.

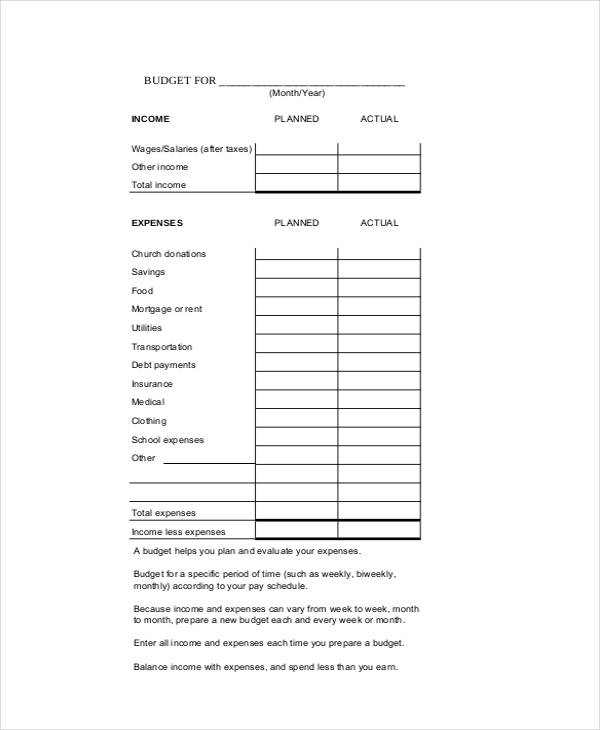

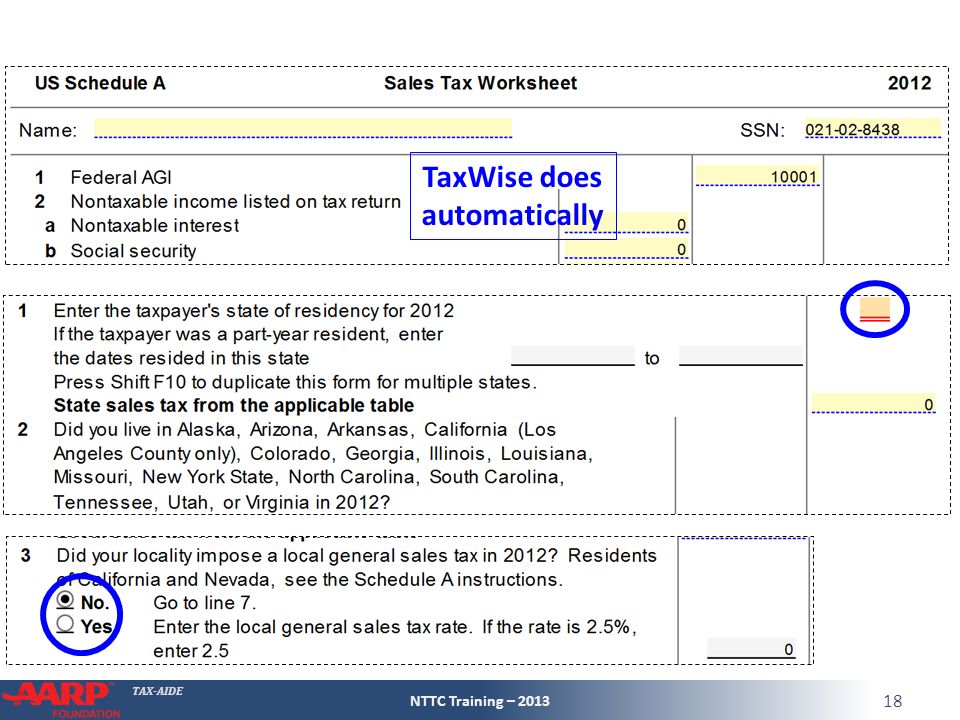

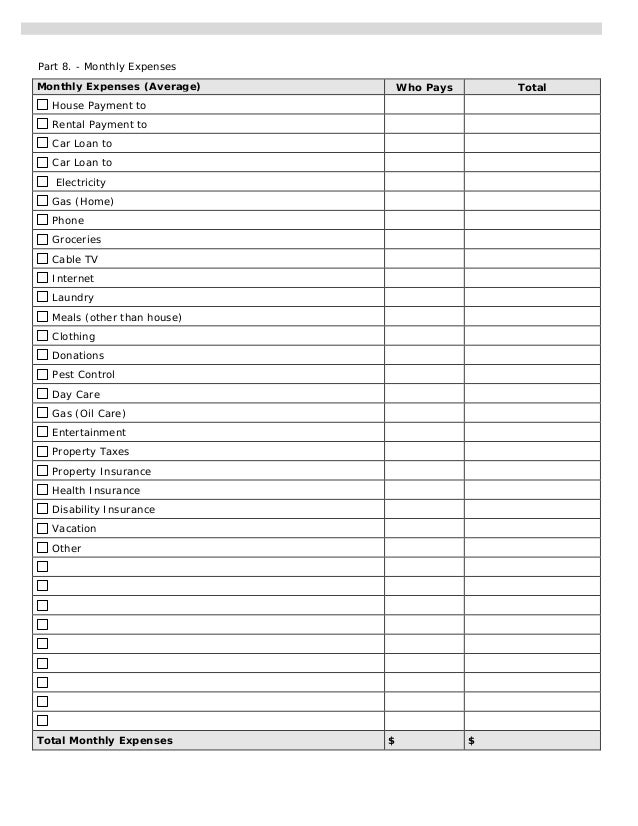

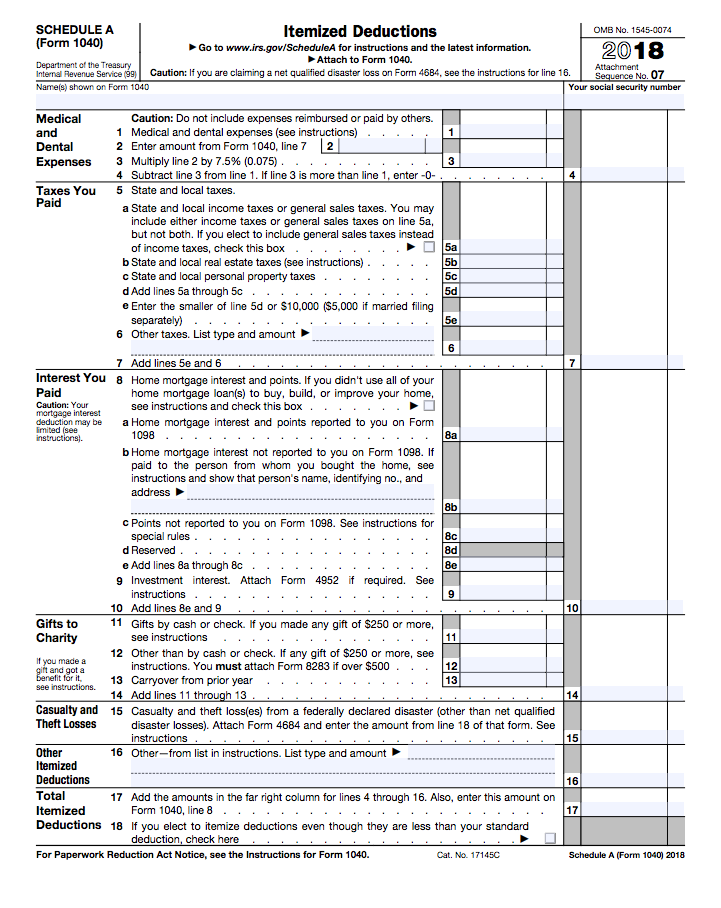

How to itemize a clothing list for deduction finance zacks starting in 2018 the standard deduction for single filers is 12 000 and married couples filing jointly will have a 24 000 standard deduction.Here s a cash flow program.Free clothing donation tax receipt word pdf eforms.

20th two separate valuation reports should be made for each date.Set your own value.When you arrive in their page that is principal all you ve got to do is either pick one of many templates they give or start fresh.

Insert tax year insert date given enter items not provided for in the above categories.My our best guess of value non cash charitable contributions donations worksheet.July 1st to arc and another donation to arc on sept.

:max_bytes(150000):strip_icc()/ScreenShot2019-10-03at11.26.37AM-d878d5cb84de4e9692a9b0ed035581b9.png)

:max_bytes(150000):strip_icc()/GettyImages-583903612-5b588612c9e77c00785d6d7e.jpg)