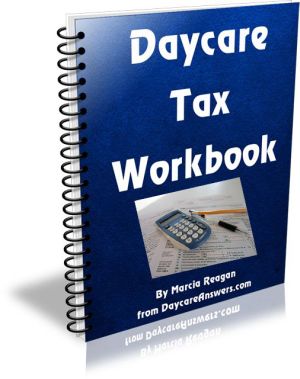

Home Daycare Tax Worksheet

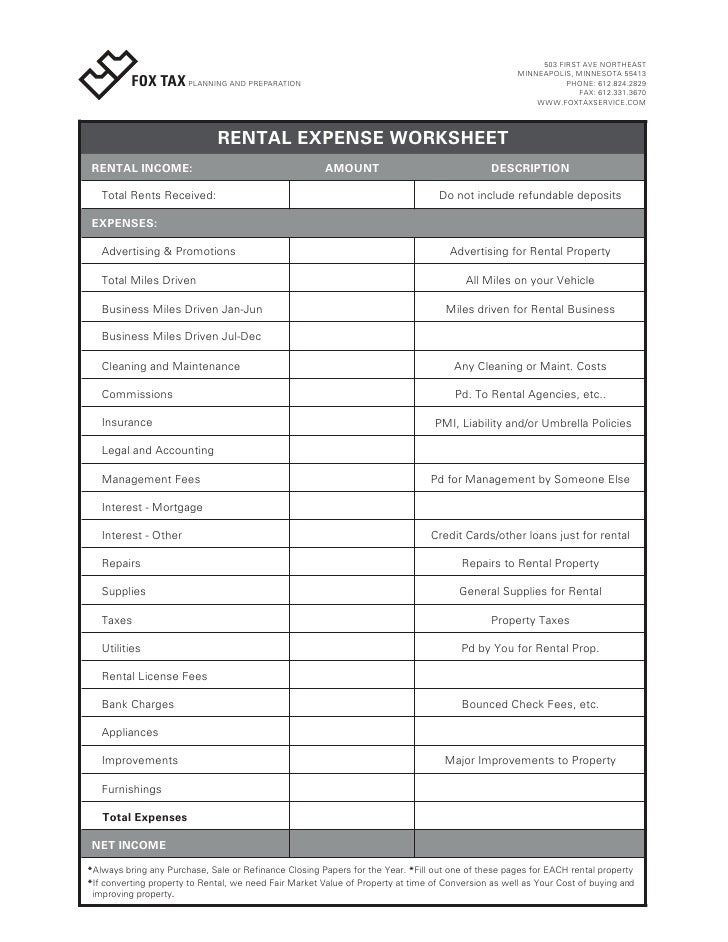

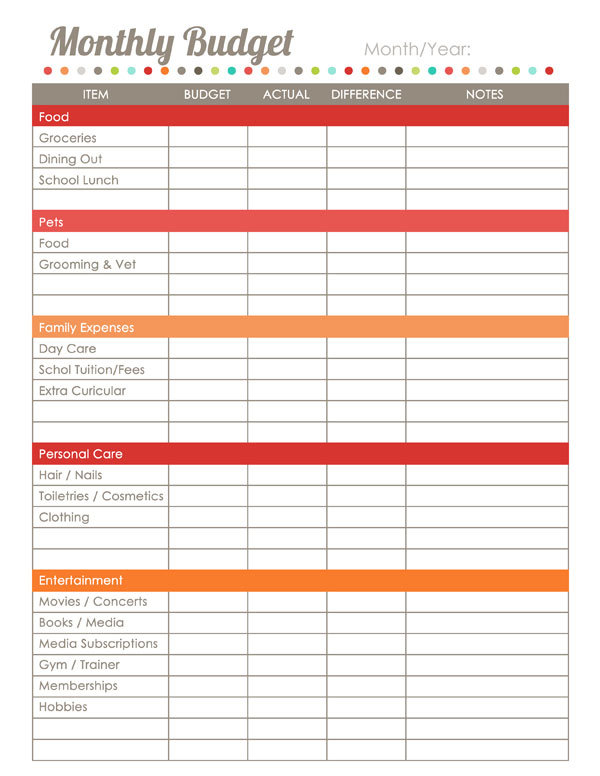

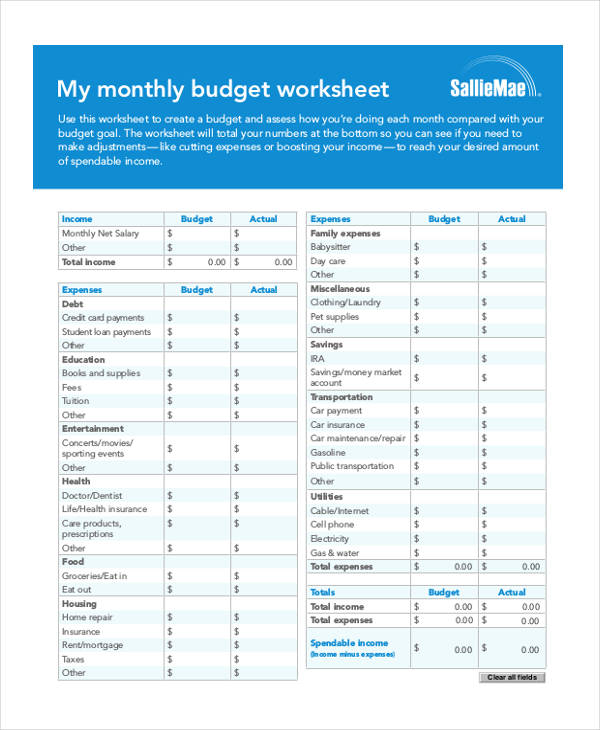

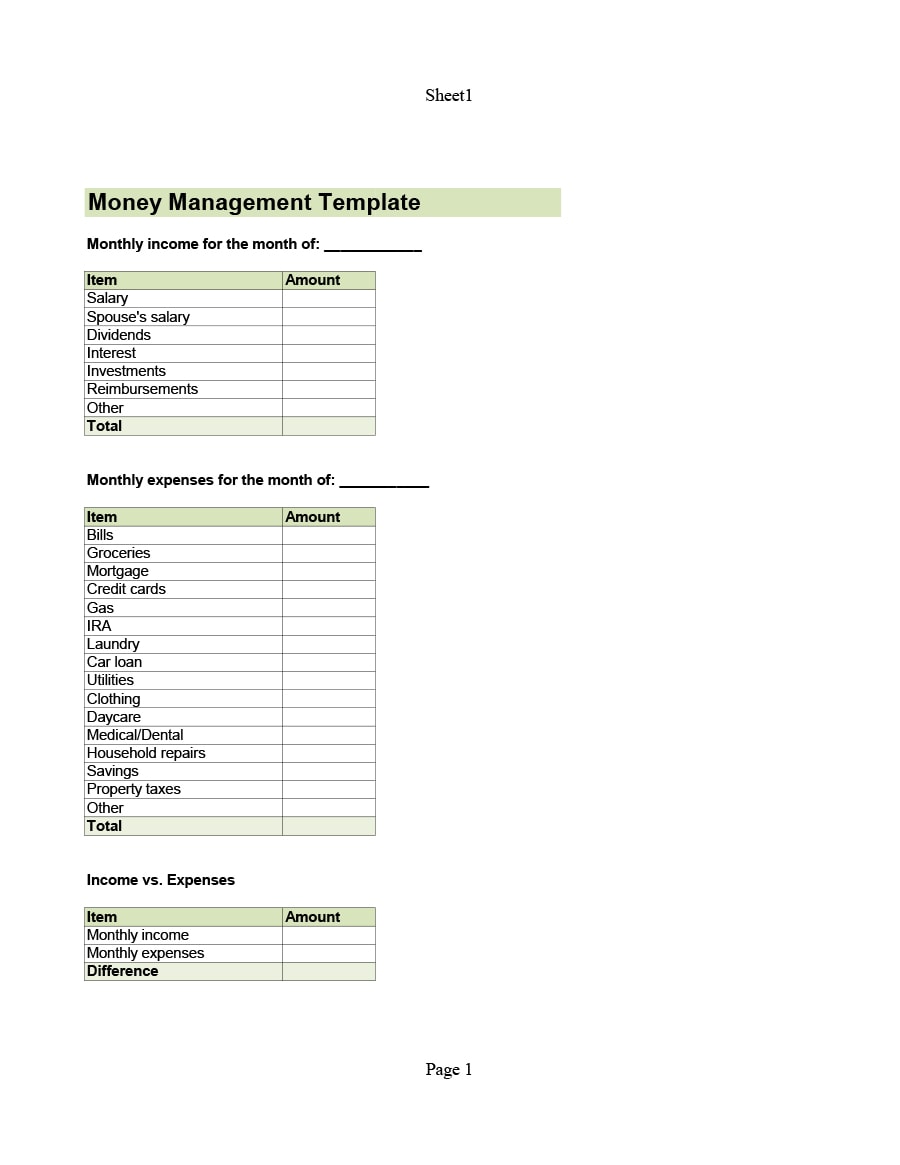

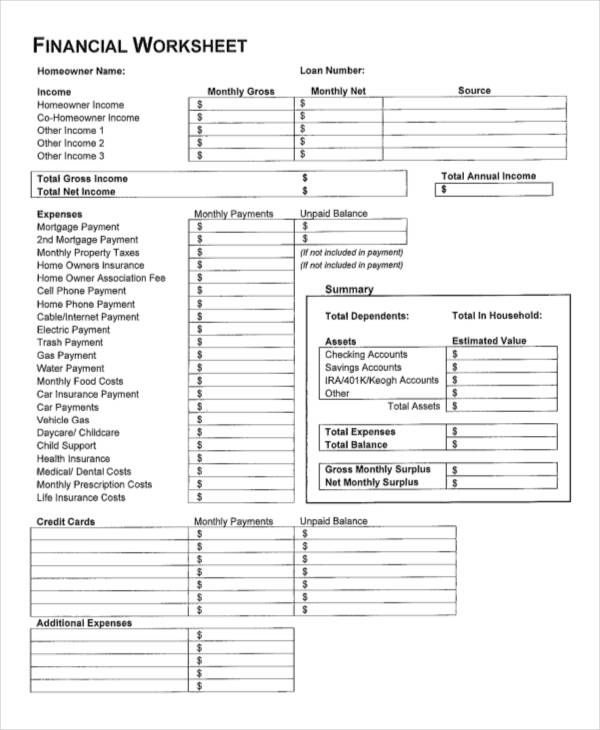

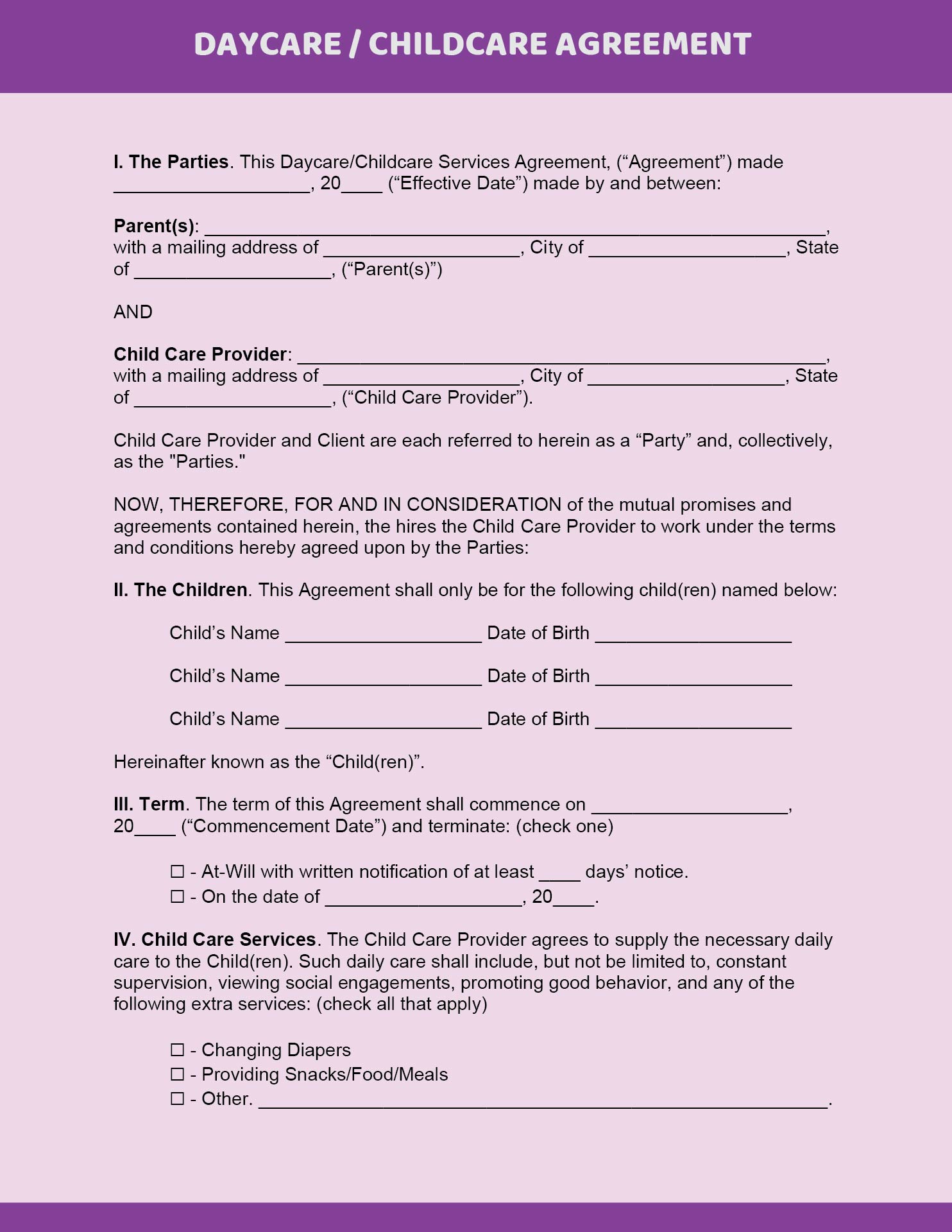

Some items you can write off the whole cost while others will need to have your t s applied.

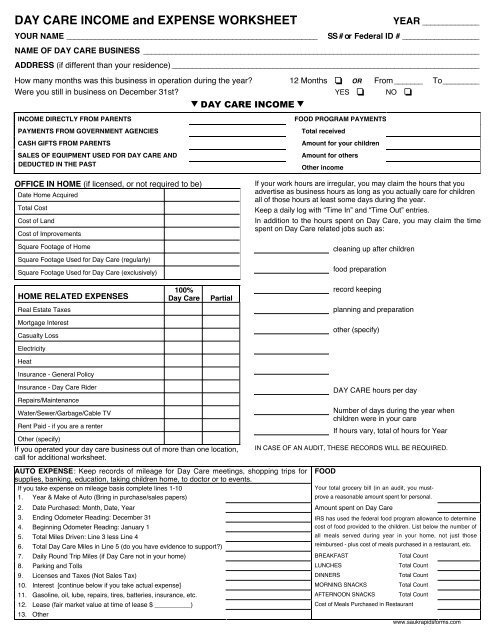

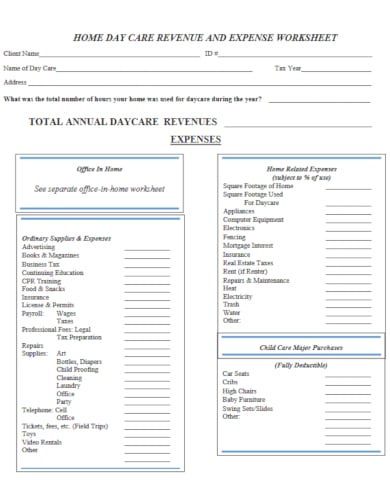

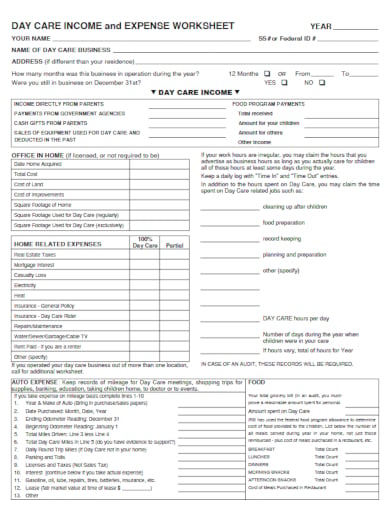

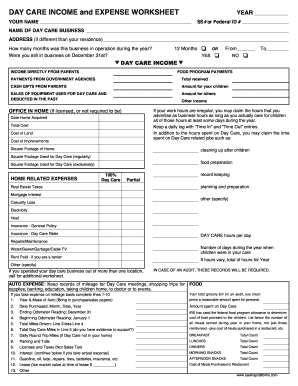

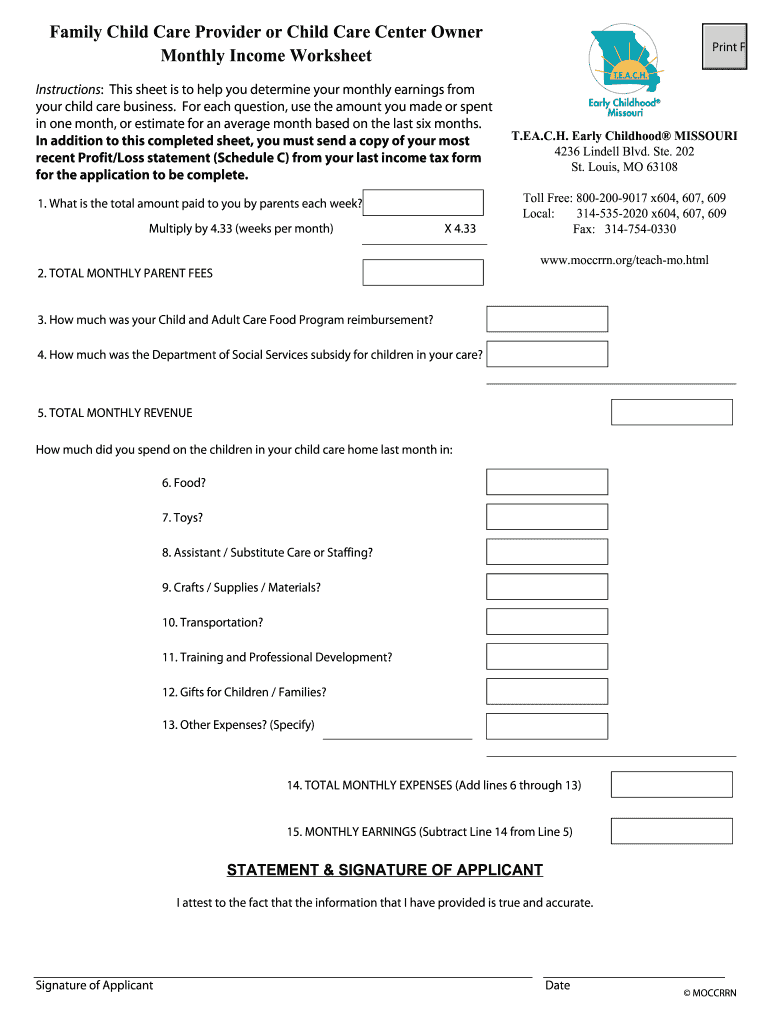

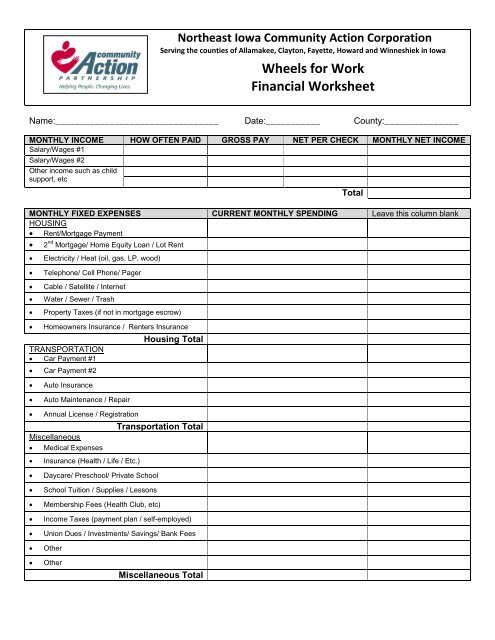

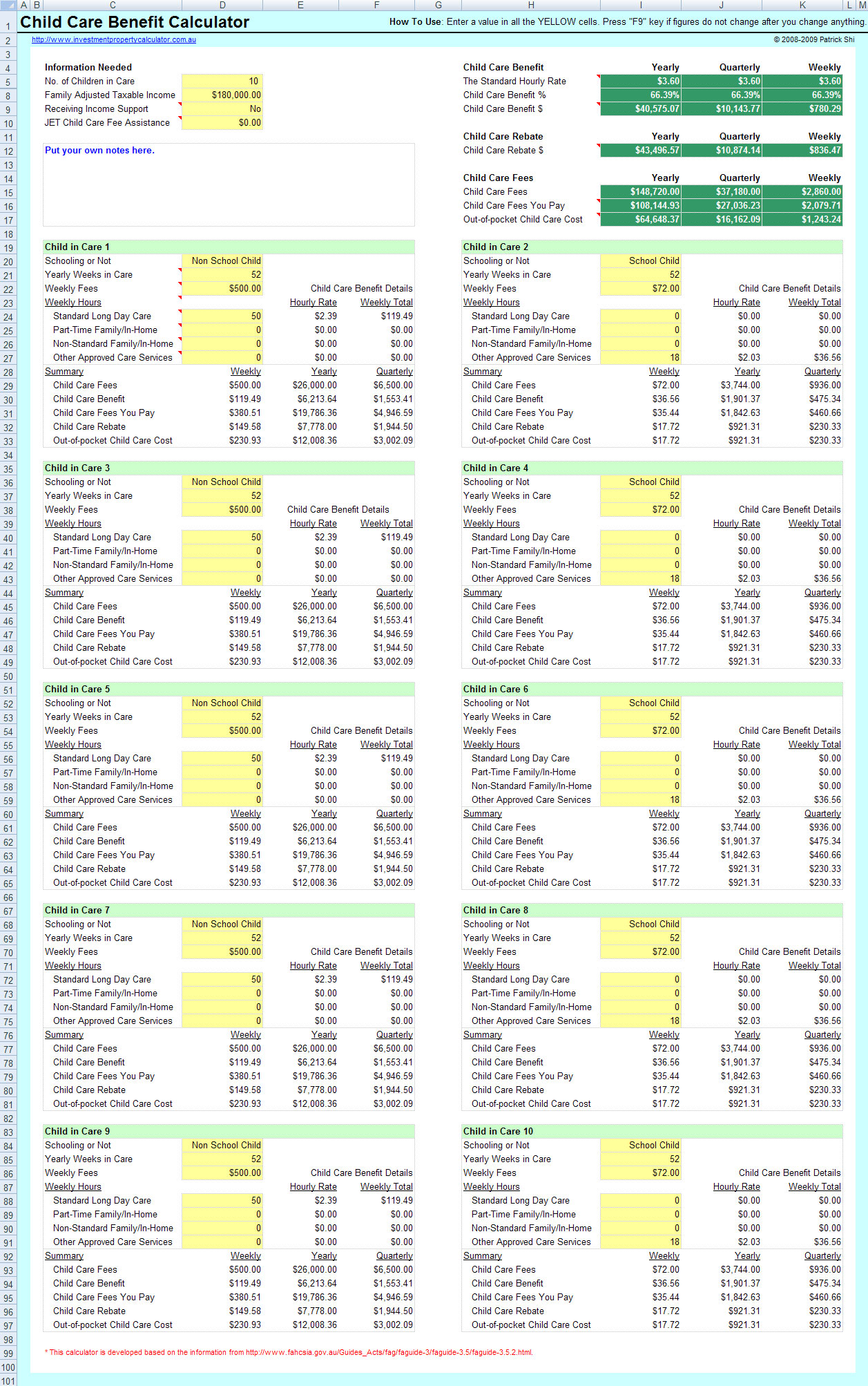

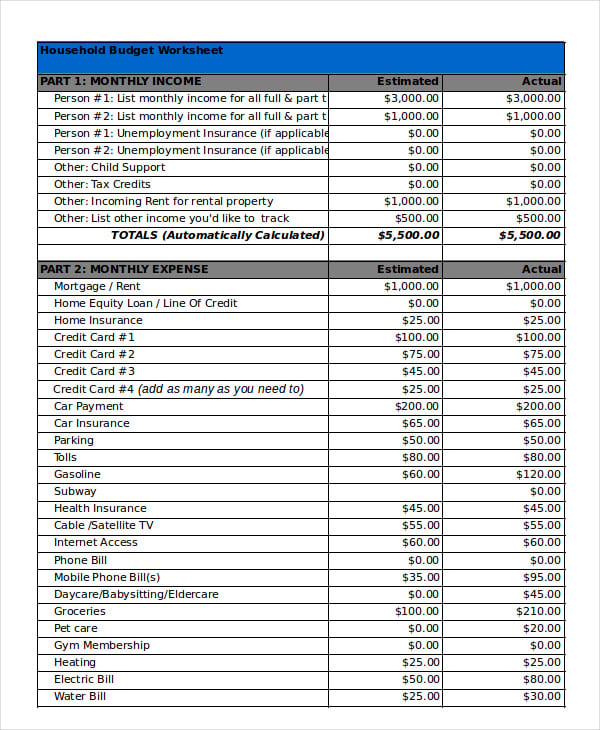

Home daycare tax worksheet.Any furniture or appliance that you use in the daycare and for personal use needs to have the t s applied.Whether you do it yourself or hire a professional tax preparer this workbook makes it easy.Day care income and expense worksheet day care income and expense worksheet.

Home daycare tax deductions for child care providers.If you take expense on mileage basis complete the following lines auto 1 auto 2 auto 3.End of year checklist.

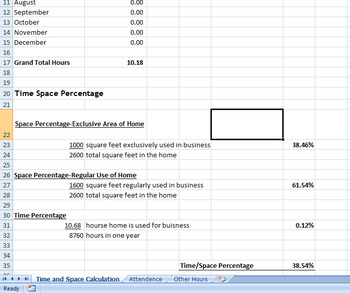

Keep records of mileage for day care meetings shopping for supplies groceries or to events etc.Office in home.Via tips about presentation producing to cooking ebook describes or to determining the kind of content for your formula most of us make.

This past year the irs has launched a campaign of new audits and is concentrating on small business owners.Furniture and appliance purchases can be written off as home daycare tax deductions.Day care providers worksheet lake stevens tax service day care providers worksheet for the tax year welcome back for another tax preparation adventure.

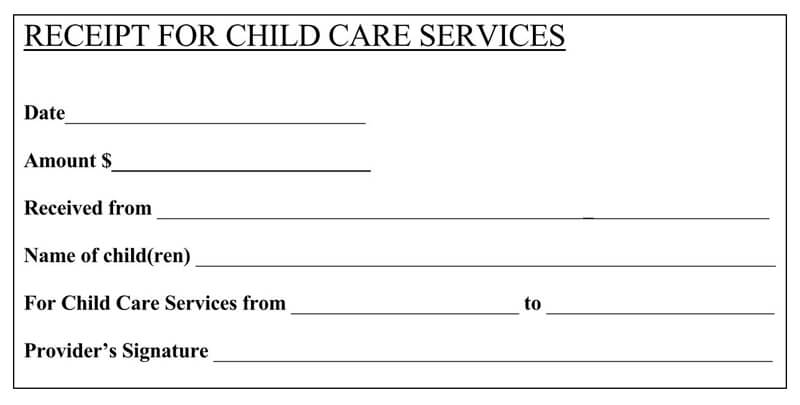

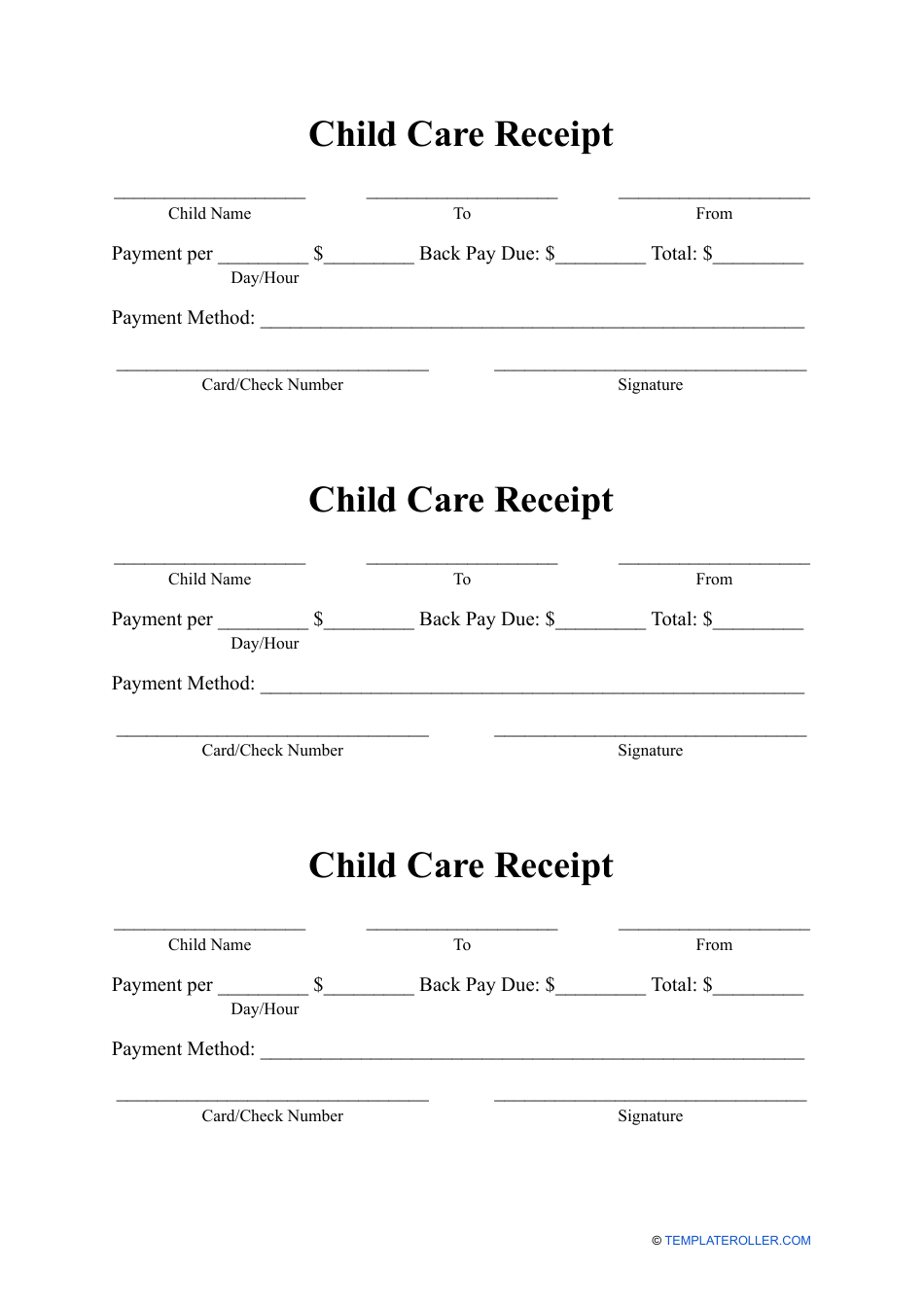

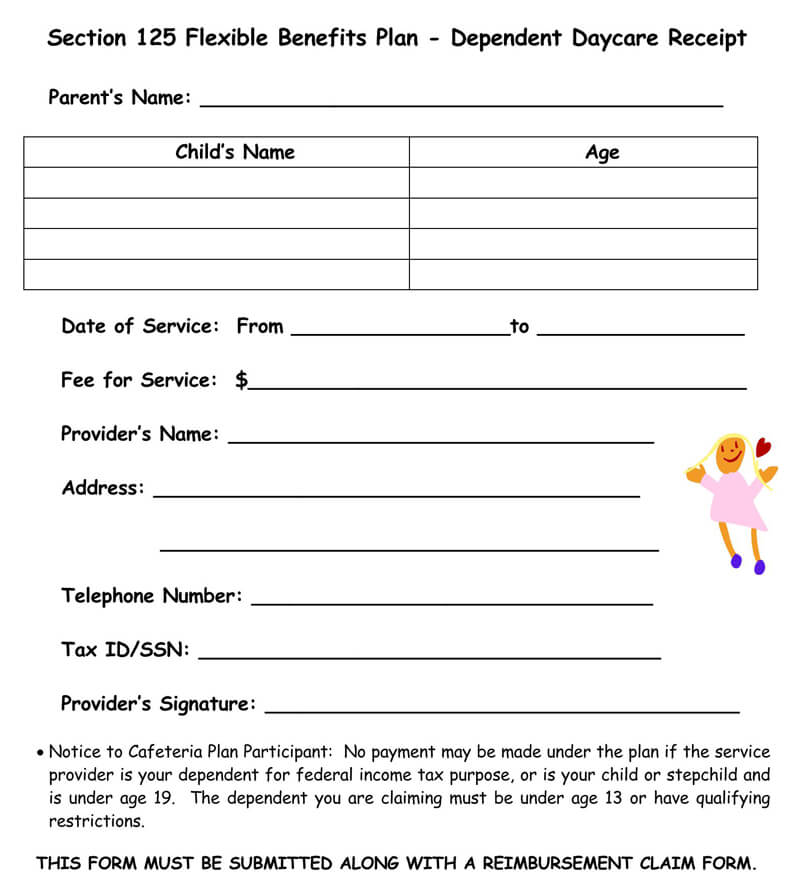

End of year receipts w 10 weekly receipts.Daycare in your home canada ca information for persons operating a day care in their home including such topics as keeping records issuing receipts expenses tax payments hiring employees and reporting income.